From the Trenches: A Personal Story of Obama Job-Killing Regulation

by

Lawrence Meyers

I occasionally broker commercial loans between finance companies and small businesses.

It gives me a lot of pride when I bring together an American entrepreneur who is ready to risk all his assets on his own business, with a finance company that sees a way to help that businessman and make a profit himself.

For the past month, I’ve been working with a financier to bring funding to 30 entrepreneurs, eager and ready to start up their businesses.

Yesterday I had the most dis-spiriting conversation of my professional career with my financier, whom I’ll call “Joe”.

Joe has a credit line with a Gigantic American Bank.

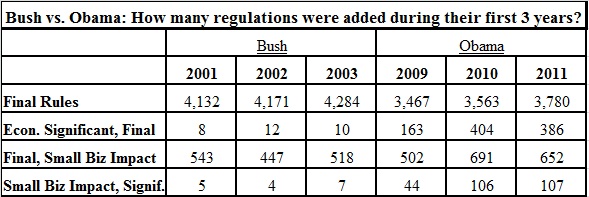

The Federal Reserve has slapped the Bank, and all other banks big and small, with new regulations regarding how they loan their money, who they loan it to, and issued a mountain of compliance rules.

The Bank cannot rely on their internal compliance auditors any longer, either.

They must use independent auditors.

The Bank, in order to remain in compliance, must shove all these same regulations and compliance rules onto whomever they loan money to, including Joe, who also must engage an independent compliance auditor.

Joe must shove all these same regulations and compliance rules onto whomever he loans money to, including these entrepreneurs, who also must engage an independent compliance auditor.

The cost of all these regulations and compliance audits, at the entrepreneur level alone, is $30,000. It costs a heck of a lot more as you move up the chain.

The entrepreneurs cannot afford this.

As a result, the entrepreneurs’ dreams of starting their own businesses die on the vine. They now must go back into the depressed job market to (not) find a job.