Hello everyone. Ive been working the preload shift for almost two years now, and noticed that there is a credit card for ups employees. I have tried contacting Bank of America and searching the web for information, but I cant find what I am searching for. I am trying to figure out what the general credit score is to be accepted for this card. My credit score isnt the best so this card would be awesome. Thank you in advance for any helpful information given.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

UPSers Credit Card (on topic)

- Thread starter UPSfit

- Start date

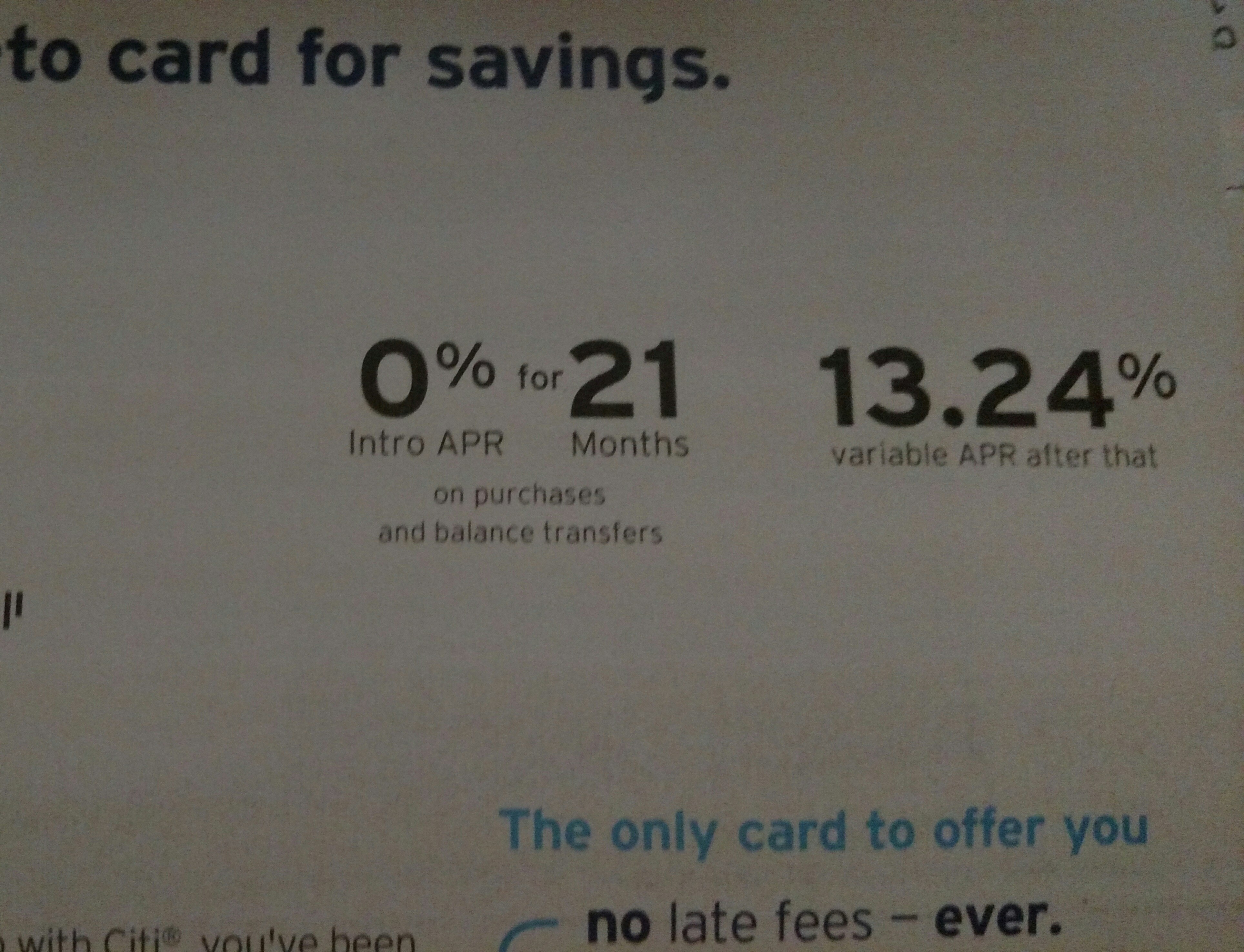

It has a good interest rate but crappy reward points.

Ya this would be my second card. The one I have now is a secured card with 24.99% apr, but I just use it for monthly bills like Netflix and pay it off each month. This card would be a HUGE upgrade, but I dont want to take a hard inquiry when there was no chance at all of getting accepted.

24.99%Ya this would be my second card. The one I have now is a secured card with 24.99% apr, but I just use it for monthly bills like Netflix and pay it off each month. This card would be a HUGE upgrade, but I dont want to take a hard inquiry when there was no chance at all of getting accepted.

How bad is your credit?

I use https://www.creditkarma.com/ to keep an eye on my credit score. It's free and they send you a notification if your score changes. They also give you suggestions for raising your score, which might be useful to you.

The one thing they always suggest for me is to get another credit card, but since my credit is still really good I haven't bothered with that.

They also try to get you to sign up for stuff from their partners, I just ignore that part.

The one thing they always suggest for me is to get another credit card, but since my credit is still really good I haven't bothered with that.

They also try to get you to sign up for stuff from their partners, I just ignore that part.

I have several cards with different due dates and different rewards. I use their money!I use https://www.creditkarma.com/ to keep an eye on my credit score. They give you suggestions for raising your score, which might be useful to you.

The one thing they always suggest for me is to get another credit card, since my credit is still really good so I haven't bothered with that.

They also try to get you to sign up for stuff from their partners, but I just ignore that part.

Since November I have over $300 in rewards cash. I use that for my October vacation.

We use 2 cards. One is the Costco rewards card where we shop a couple of times a week. We get a few hundred dollars from that every February. The other one is a American Airlines miles card we've had for a long time so we've built up a lot of miles on it. Those miles come in handy for vacations.I have several cards with different due dates and different rewards. I use their money!

Since November I have over $300 in rewards cash. I use that for my October vacation.

UpstateNYUPSer(Ret)

Well-Known Member

24.99%

How bad is your credit?

24.99% secured credit card.

I have several cards,I only use three. The only reason I keep the others is because I had them a long time and it looks good on your credit history .We use 2 cards. One is the Costco rewards card where we shop a couple of times a week. We get a few hundred dollars from that every February. The other one is a American Airlines miles card we've had for a long time so we've built up a lot of miles on it. Those miles come in handy for vacations.

My Master card gives me 1 and a half back on everything. I use Discover card,just for the 5% back and extra promotions . American Express gives me 1% on everything, 2% at the grocery store and 3% on gas.

I'm using their money! They got enough off of me when I was young.

I seen that. Hence,that's why I asked him how bad his credit was. If he has a secured card.24.99% secured credit card.

UpstateNYUPSer(Ret)

Well-Known Member

I use https://www.creditkarma.com/ to keep an eye on my credit score. It's free and they send you a notification if your score changes. They also give you suggestions for raising your score, which might be useful to you.

The one thing they always suggest for me is to get another credit card, but since my credit is still really good I haven't bothered with that.

They also try to get you to sign up for stuff from their partners, I just ignore that part.

My son and I both use Credit Karma. He finds the tutorials and recommendations to be quite helpful.

I use credit karma but unfortunately they dont have special employee cards on there, to give me a guideline. It is 560/585 right now, if I can get this collection taken off after I make my final payment later this month, it should go up significantly. I am hoping employee only cards take pity on poor credit for their employees haha.

UpstateNYUPSer(Ret)

Well-Known Member

I seen that. Hence,that's why I asked him how bad his credit was. If he has a secured card.

I would guess his FICO is less than 650.

Guess I was wrong. 560-585? There is no way you are going to get anything but a secured card until you get that score up to at least 600-625.

When you have good credit you get offer like this.

What many youngsters fail to realize is,how much bad credit can cost you over your lifetime.I would guess his FICO is less than 650.

Guess I was wrong. 560-585? There is no way you are going to get anything but a secured card until you get that score up to at least 600-625.

Many don't realize that your insurance company checks your credit score.

Low score = higher rates.

UpstateNYUPSer(Ret)

Well-Known Member

I have one credit card and one debit card. I use the debit card for the majority of my purchases. I use the credit card for any online shopping that I do, which is very rare. I pay that balance off in full every month. It's not a rewards card but that is not a big deal to me.

I take the free money.I have one credit card and one debit card. I use the debit card for the majority of my purchases. I use the credit card for any online shopping that I do, which is very rare. I pay that balance off in full every month. It's not a rewards card but that is not a big deal to me.

brownmonster

Man of Great Wisdom

I haven't personally paid a bill in over 30 years. I earned my 800 credit score.

Similar threads

- Replies

- 43

- Views

- 4K

- Replies

- 12

- Views

- 2K

- Replies

- 127

- Views

- 25K

- Replies

- 164

- Views

- 24K

- Replies

- 25

- Views

- 6K