You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

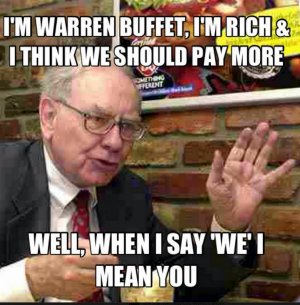

Warren Buffet

- Thread starter Jones

- Start date

The poor pay the most regressive tax of all. It's called inflation.

He has no idea what he's talking about.

Peace

av8torntn

Well-Known Member

Just the past thirty years of trickle-down Reaganomics. Today it is paying homage to the "job creators". As far as idiots, does that also include Buffet?

My goodness no Mr. Buffet knows an increase in taxes will have a positive influence on his business of buying companies. I'm sure he would love to see an inheritance tax of 100% at least for the near term. We all know if the man wanted to pay more taxes he is free to do just that but he does not. One does not need the government to force you to give them more money if you are willing. He could in thirty days time pony up fourty billion or so if he is serious but he will not because that would be harmful to him.

A higher income tax will not keep him from being wealthy only those walking his path behind him.

Ah. So Buffet's comments should be viewed simply as a man who's gotten his? Because...he's a ...job creator? That's why he pays a lower tax rate than his sec'y?

Exactly, he paid what? 14% on his billions...

Yeah AV8, the rich have it tough. Keep sticking up for them!

Peace.

wkmac

Well-Known Member

A higher income tax will not keep him from being wealthy only those walking his path behind him.

Bingo. It's all about the limiting and suppressing market competition. Gabriel Kolko, "The Triumph of Conservatism" is a great read (some of it is open source google books) in understanding how this was achieved, under what name(s) and by who. Another very quick example that touches the spear tip is from 1997' by Mises Jeffery Tucker about the Marshall Plan.

Once we (everyone) understand the Jeffersonian ideal never really happened and never had a chance and that the real father of our markets was the one who won and has always won the day, it is then the real conversation can begin.

moreluck

golden ticket member

Sorry moreluck, your wrong again... (whats new).

The poorest americans PAY PLENTY of taxes. As the deficits grow in each state and SALES TAXES increased, the MOST affected are the POOR. Rich people dont visit the supermarket or department stores more than the poorest of americans, and its those americans who pay the highest price for services. The poor, dont have access to wholesale products or goods like rich people do. The poor, cant buy in bulk like rich people do and the poor dont have the options of traveling to states to avoid taxes.

At the end of the day, the POOR pay the most and get the LEAST out of taxes.

Peace.

I'm talking INCOME TAXES. I didn't know we were talking luxury tax on the Monopoly Board!!

Babagounj

Strength through joy

http://www.fms.treas.gov/faq/moretopics_gifts.html

[h=2]Gifts to the United States Government[/h] How do I make a contribution to the U.S. government?

Citizens who wish to make a general donation to the U.S. government may send contributions to a specific account called "Gifts to the United States."

This account was established in 1843 to accept gifts, such as bequests, from individuals wishing to express their patriotism to the United States.

Money deposited into this account is for general use by the federal government and can be available for budget needs.

These contributions are considered an unconditional gift to the government.

Financial gifts can be made by check or money order payable to the United States Treasury and mailed to the address below.

at (800) 829-1040.

at (800) 829-1040.

[h=2]Gifts to the United States Government[/h] How do I make a contribution to the U.S. government?

Citizens who wish to make a general donation to the U.S. government may send contributions to a specific account called "Gifts to the United States."

This account was established in 1843 to accept gifts, such as bequests, from individuals wishing to express their patriotism to the United States.

Money deposited into this account is for general use by the federal government and can be available for budget needs.

These contributions are considered an unconditional gift to the government.

Financial gifts can be made by check or money order payable to the United States Treasury and mailed to the address below.

Gifts to the United States

U.S. Department of the Treasury

Credit Accounting Branch

3700 East-West Highway, Room 622D

Hyattsville, MD 20782

Any tax-related questions regarding these contributions should be directed to the Internal Revenue Service

U.S. Department of the Treasury

Credit Accounting Branch

3700 East-West Highway, Room 622D

Hyattsville, MD 20782

at (800) 829-1040.

at (800) 829-1040.moreluck

golden ticket member

http://www.fms.treas.gov/faq/moretopics_gifts.html

[h=2]Gifts to the United States Government[/h] How do I make a contribution to the U.S. government?

Citizens who wish to make a general donation to the U.S. government may send contributions to a specific account called "Gifts to the United States."

This account was established in 1843 to accept gifts, such as bequests, from individuals wishing to express their patriotism to the United States.

Money deposited into this account is for general use by the federal government and can be available for budget needs.

These contributions are considered an unconditional gift to the government.

Financial gifts can be made by check or money order payable to the United States Treasury and mailed to the address below.

Gifts to the United StatesAny tax-related questions regarding these contributions should be directed to the Internal Revenue Service

U.S. Department of the Treasury

Credit Accounting Branch

3700 East-West Highway, Room 622D

Hyattsville, MD 20782

at (800) 829-1040.

I'm so glad you posted that address.....now where did I put my envelopes ??..........Oh, do you have any stamps ??

Similar threads

- Replies

- 51

- Views

- 3K

- Replies

- 148

- Views

- 6K

- Replies

- 223

- Views

- 14K

- Replies

- 82

- Views

- 4K