GeneralPike37vs26

Member

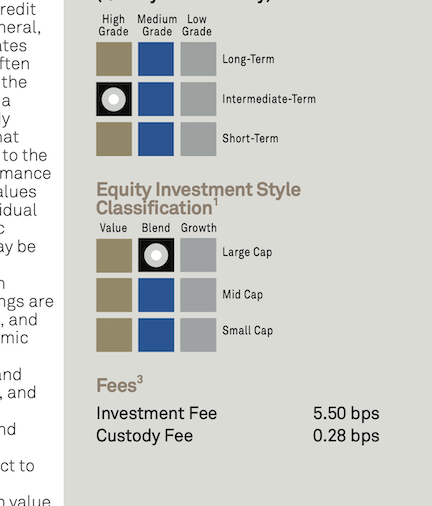

After a couple of years of investing in my Bright Horizons 401k retirement fund I started looking a little closer into the fees. Can someone verify the fees to me.

At first glance it looks like there is a 5.5 basis points out of 100 which equals 5.5% off the top. (front end load) Does this sound right? So before they make you a single dollar you pay them 5.5%. Or am I doing the math wrong on basis points?

Then there is a fund management fee of 2.8 basis points.

I have to be doing this wrong.

At first glance it looks like there is a 5.5 basis points out of 100 which equals 5.5% off the top. (front end load) Does this sound right? So before they make you a single dollar you pay them 5.5%. Or am I doing the math wrong on basis points?

Then there is a fund management fee of 2.8 basis points.

I have to be doing this wrong.

, theres not really any freedom on where and when you can put your money, fees, all 401k are eventually going to become Roth's.

, theres not really any freedom on where and when you can put your money, fees, all 401k are eventually going to become Roth's.