You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Retro check tax rate

- Thread starter laffter

- Start date

Too bad we cant put It all in our 401k. Just like option week or personal daysDragon said:Taxed at your regular rate, I went thru a presentation today.

401k

If you have any garnishments that are percentage of your weekly check that will also come out.

That's awesomeTaxed at your regular rate, I went thru a presentation today.

401k

If you have any garnishments that are percentage of your weekly check that will also come out.

You can change it for a while to off set it.Too bad we cant put It all in our 401k. Just like option week or personal days

[quote Mr. Bojangles, post: 1319267, member: 52022"]You can change it for a while to off set it.[/quote]

I understand that. Just do not understand,why that option wasnt given.

I understand that. Just do not understand,why that option wasnt given.

I understand that. Just do not understand,why that option wasnt given.[/quote][quote Mr. Bojangles, post: 1319267, member: 52022"]You can change it for a while to off set it.

Me either.

Me either.[/quote]I understand that. Just do not understand,why that option wasnt given.

If we had that option, alot of people who dont add to their 401k, might put this retro money In. they made it this far without the money...why not put it in?

If we had that option, alot of people who dont add to their 401k, might put this retro money In. they made it this far without the money...why not put it in?[/quote] I agree. People need help saving their money. That's for sure.Me either.

bottomups

Bad Moon Risen'

If we had that option, alot of people who dont add to their 401k, might put this retro money In. they made it this far without the money...why not put it in?[/quote]Me either.

I'm going to go ask my wife if I can put it in.

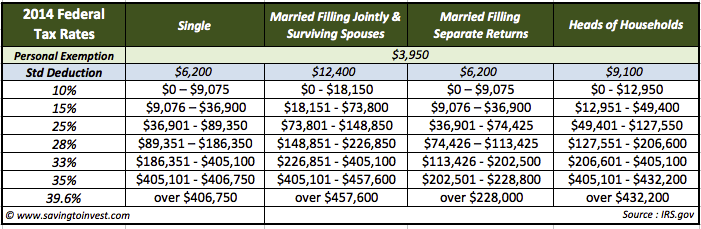

Last week, my part time sup, during our PCM, mentioned that he heard our back-pay would be taxed at 40%. In another thread, here, I read that it would be taxed at the normal rate.

Does anyone have any factual information about this?

This stuff drives me crazy. Look at this chart. Most of us are taxed between 15 to 28 percent. It seems more because the numbers go up on big checks.

Here's a link to an online paycheck calculator. You can enter the wage amount and then tweak the taxes and deductions to see the effect on the net pay. http://www.adp.com/tools-and-resour...l-calculators/hourly-paycheck-calculator.aspx

brownmonster

Man of Great Wisdom

Putting the retro in my 401k would be like a rain drop in the ocean. Lol.

Sent using BrownCafe App

Sent using BrownCafe App

I'm going to go ask my wife if I can put it in.[/quote]If we had that option, alot of people who dont add to their 401k, might put this retro money In. they made it this far without the money...why not put it in?

Just going to add my retro check to my roth IRA and I bumped up my 401k another percent.

brown_trousers

Well-Known Member

Its never that easyI'm going to go ask my wife if I can put it in.

Cheap hookers and good beer! I assume?I'm going to spend mine on beer and hookers.

Wally

BrownCafe Innovator & King of Puns

I'm going to spend mine on beer and hookers.

Not necessarily in that order either!

Similar threads

- Replies

- 27

- Views

- 7K

- Replies

- 146

- Views

- 10K