http://www.chrismartenson.com/blog/fed-buys-last-weeks-treasury-auction/23880

The Fed Buys Last Week's Treasury Notes

Thursday, August 6, 2009, 12:11 pm, by cmartenson

I've started a new service for enrolled members called the Martenson Insider where I will be putting my more timely and market-sensitive thoughts. This week it is freely available to all.

Here's a recent example illustrating that the Fed's actions are more consistent with financial desperation than economic health.

In concert with the claims I made in the prior Martenson Insider post, The Fed bought $7 billion in Treasuries today and even more yesterday.

This is at the upper end of their recent range of already exceptional purchasing activity.

If things are so rosy that every single dip is being bought in the stock market with a vengeance, I wonder why these printing operations are really necessary?

This $14 billion plus buying activity by the Fed represents fresh money created out of this air that was exchanged for the sovereign debt of the US. However, since the Fed has, for all practical purposes, never undone its permanent operations (hey, that's why they are called "POMOs") we can consider these additions of money as good as permanent themselves.

.

.

Looking at the maturity range we can see that these are all long-dated bonds with the one today specifically offering us a tantalizing clue as to how the shell game is being played.

Here's the Treasury announcement for the 7-year auction that came out on July 30 (last Thursday). Please note the specific CUSIP number circled. Every bond in this auction carries this specific identifying number.

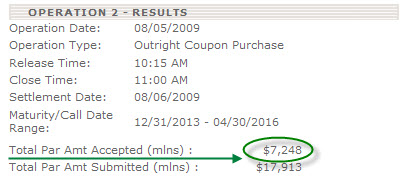

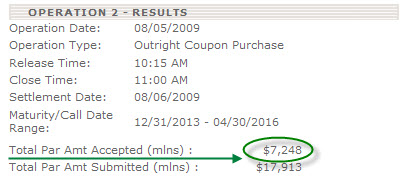

And now let's look at the detail for this most recent POMO:

Good grief! Just last week, when the auction results were announced it was trumpeted to great fanfare that there was "more than sufficient" bid-to-cover, "strong demand" and all the rest.

And now it turns out that 47% (!) of the bonds that were taken by the primary dealers in that auction have been quietly bought by the Fed and permanently secreted to its balance sheet.

They didn't even wait a full week! A more honest and open approach would have been for the Fed to simply buy them outright at the auction but this way, using "primary dealers" and "POMOs" and all these other extra steps the basic fact that the Fed is openly monetizing US government debt is effectively hidden from a not-too-terribly inquisitive US press and public.

The speed of the shell game is accelerating.

This immediate repurchase of newly auction bonds by the Fed tells us that demand for these bonds is not nearly as high as advertised, and that things are not quite as strong as represented.

And oh, by the way, don't expect any stock market weakness while so many billions are being shoveled out the Fed and into the pockets of the primary dealers. They'll have to do something with all that freshly minted cash.....

The Fed Buys Last Week's Treasury Notes

Thursday, August 6, 2009, 12:11 pm, by cmartenson

I've started a new service for enrolled members called the Martenson Insider where I will be putting my more timely and market-sensitive thoughts. This week it is freely available to all.

Here's a recent example illustrating that the Fed's actions are more consistent with financial desperation than economic health.

In concert with the claims I made in the prior Martenson Insider post, The Fed bought $7 billion in Treasuries today and even more yesterday.

This is at the upper end of their recent range of already exceptional purchasing activity.

If things are so rosy that every single dip is being bought in the stock market with a vengeance, I wonder why these printing operations are really necessary?

This $14 billion plus buying activity by the Fed represents fresh money created out of this air that was exchanged for the sovereign debt of the US. However, since the Fed has, for all practical purposes, never undone its permanent operations (hey, that's why they are called "POMOs") we can consider these additions of money as good as permanent themselves.

Looking at the maturity range we can see that these are all long-dated bonds with the one today specifically offering us a tantalizing clue as to how the shell game is being played.

Here's the Treasury announcement for the 7-year auction that came out on July 30 (last Thursday). Please note the specific CUSIP number circled. Every bond in this auction carries this specific identifying number.

And now let's look at the detail for this most recent POMO:

Good grief! Just last week, when the auction results were announced it was trumpeted to great fanfare that there was "more than sufficient" bid-to-cover, "strong demand" and all the rest.

And now it turns out that 47% (!) of the bonds that were taken by the primary dealers in that auction have been quietly bought by the Fed and permanently secreted to its balance sheet.

They didn't even wait a full week! A more honest and open approach would have been for the Fed to simply buy them outright at the auction but this way, using "primary dealers" and "POMOs" and all these other extra steps the basic fact that the Fed is openly monetizing US government debt is effectively hidden from a not-too-terribly inquisitive US press and public.

The speed of the shell game is accelerating.

This immediate repurchase of newly auction bonds by the Fed tells us that demand for these bonds is not nearly as high as advertised, and that things are not quite as strong as represented.

And oh, by the way, don't expect any stock market weakness while so many billions are being shoveled out the Fed and into the pockets of the primary dealers. They'll have to do something with all that freshly minted cash.....