i will be posting quotes from a variety of sources as to how much taxes trump paid. no one i listen to has said its not accurate. ill be posting investigative journalist david cay johnstons interview about it when it gets uploaded.

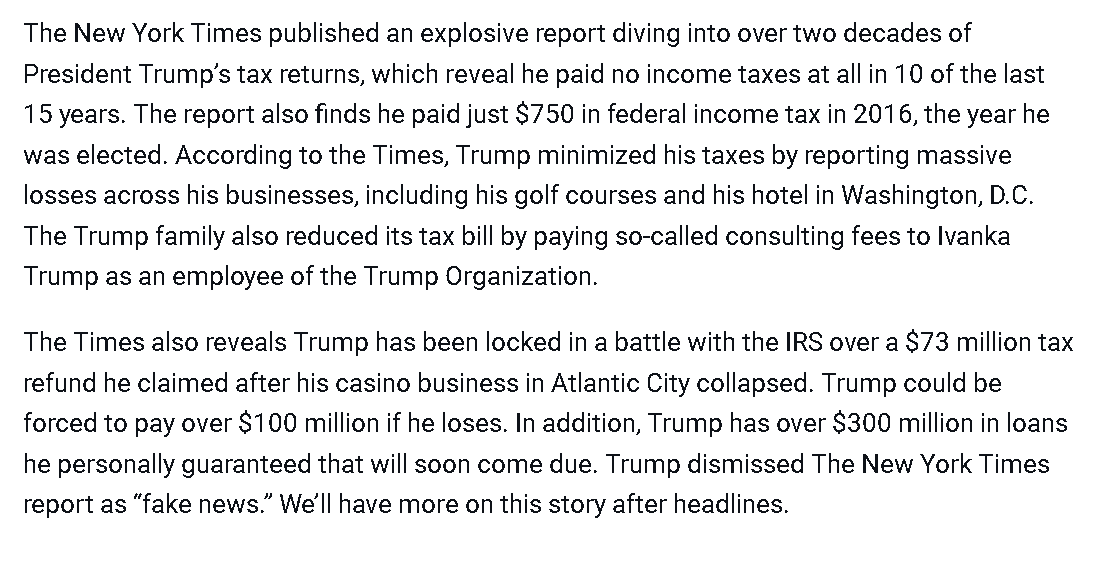

nader and public citizen:

america's most famous marxian economist:

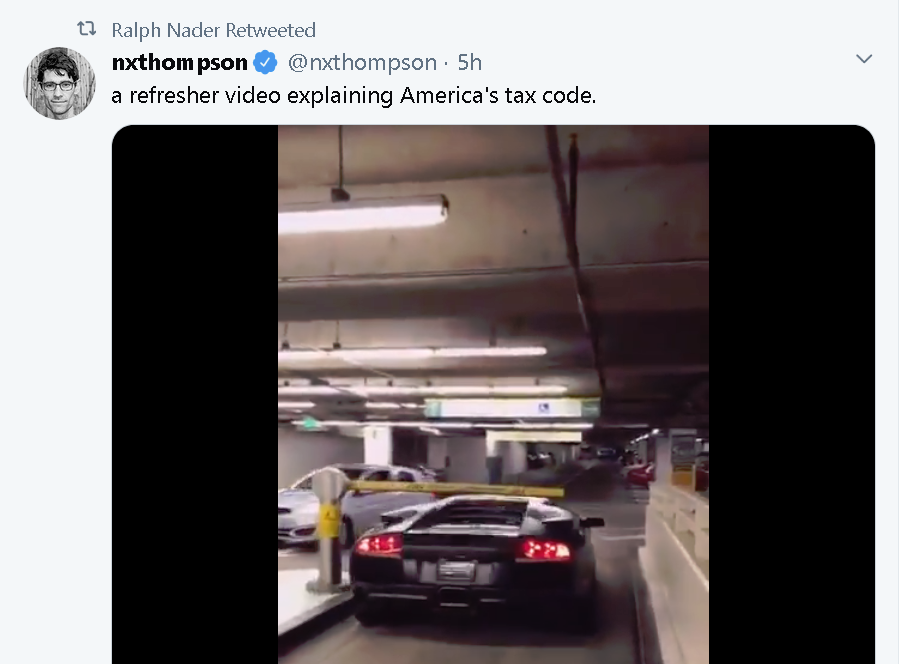

i think this was the labour secretary under bill clinton. not sure if hes a socialist but hes not a bad guy and i think he was anti nafta:

economist steve keen who i believe predicted the financial crisis of 2008:

stacy herbert, co host of an economics tv show which rec bitcoin since at least 2011:

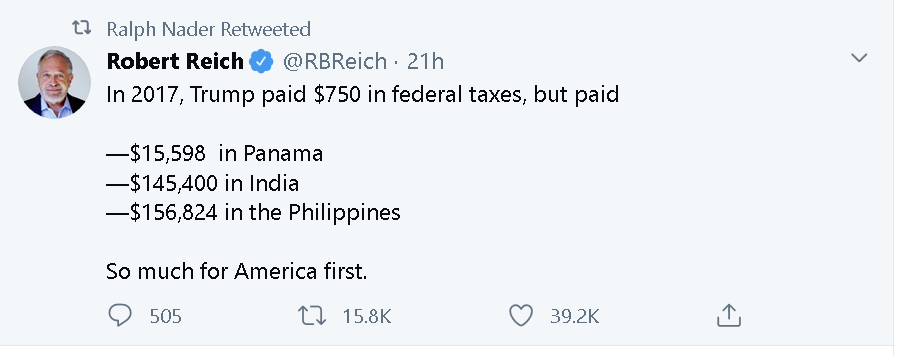

NYT: Trump Paid $750 in Fed. Income Taxes in 2016, No Income Taxes in 10 of Last 15 Years

The New York Times published an explosive report diving into over two decades of President Trump’s tax returns, which reveal he paid no income taxes at all in 10 of the last 15 years. The report also finds he paid just $750 in federal income tax in 2016, the year he was elected. According to the...

www.democracynow.org

nader and public citizen:

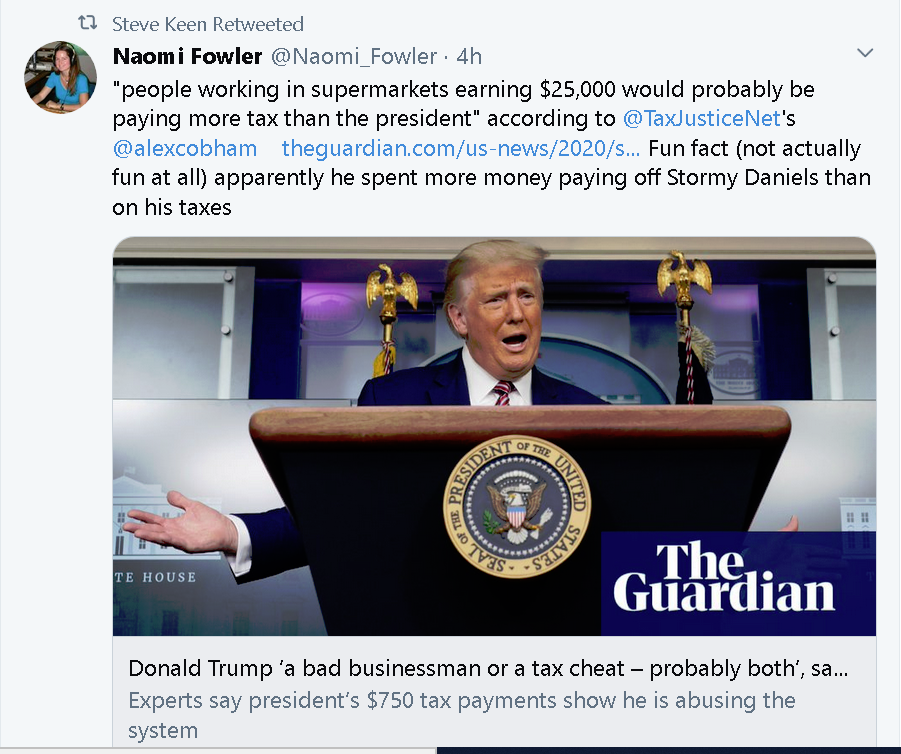

america's most famous marxian economist:

i think this was the labour secretary under bill clinton. not sure if hes a socialist but hes not a bad guy and i think he was anti nafta:

economist steve keen who i believe predicted the financial crisis of 2008:

stacy herbert, co host of an economics tv show which rec bitcoin since at least 2011:

ty that Trump (and other billionaires) can pay $750 in taxes in a year whereas I have to fork over 52% (including state). Nor did I get any 'free' Covid money. Not a penny. And yet billionaires raked in tens of billions in taxpayer 'relief' funds.

ty that Trump (and other billionaires) can pay $750 in taxes in a year whereas I have to fork over 52% (including state). Nor did I get any 'free' Covid money. Not a penny. And yet billionaires raked in tens of billions in taxpayer 'relief' funds.