MyTripisCut

Never bought my own handtruck

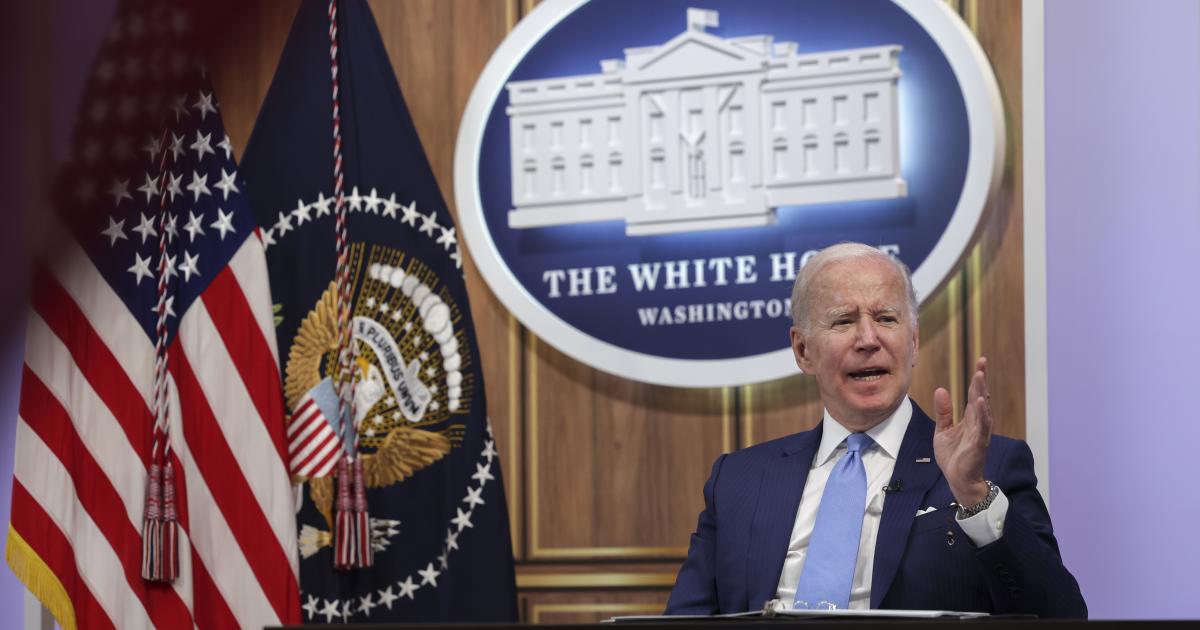

Pension cuts are 'not going to happen': Biden announces federal bailout for troubled union pension fund

A $36 billion bailout for a troubled pension fund will help more than 350,000 truck drivers, warehouse workers, construction workers and others.

www.usatoday.com

But let’s keep pulling against Democrats…..eventually we will

ourselves like we always wanted.

ourselves like we always wanted.