Empty Pockets

Well-Known Member

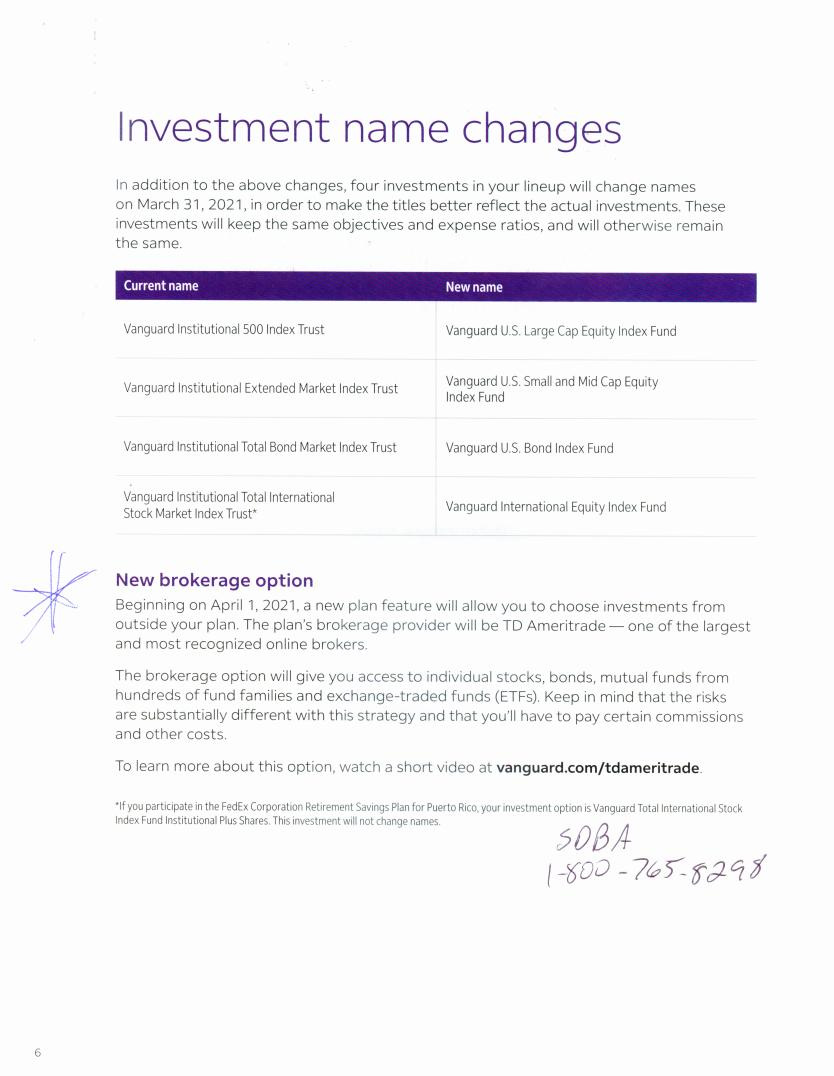

I moved/allotted 90% of my funds into TD Ameritrade a few months ago but have only made two trades so far. If you know how to trade stocks, this is about the best thing that has ever happened to our 401K.

Vanguard has not made it easy to find. I had to call them to walk me through the process. When I got to the transfer page, I had to call them again.

This will be awesome of we can jump in a bear ETF before the next crash and gain 50% on the way down. Then, ride it back up more than 50% back up just about the time I am gonna retire.

Short video/advertisement

Vanguard has not made it easy to find. I had to call them to walk me through the process. When I got to the transfer page, I had to call them again.

This will be awesome of we can jump in a bear ETF before the next crash and gain 50% on the way down. Then, ride it back up more than 50% back up just about the time I am gonna retire.

Short video/advertisement

Last edited: