You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Oil

- Thread starter moreluck

- Start date

wkmac

Well-Known Member

I don't believe we do get there because nobody wants to sell oil in the Midwest from Canada at $42/barrel when they can ship it to the coast at a cost of $56/barrel and sell it in India at a cost of $67/barrel and a price at market of $112/barrel.

But what if the midwest were free to explore other energy options without any gov't or market interference at all? What if the midwest for example could grow corn for alcohol or what if they could freely grow hemp and convert to oil.

Rudolph Diesel, father of the diesel engine, designed his engine to run off plant based oils because at the time of his invention, there was no such thing as diesel fuel. His initial idea was to use coal dust as a fuel. Diesel fuel did not come into play until the 1920's when in 1922' the first injection pump was invented. In 1927' the first experimental diesel car hit the road. One is left to explore the rich fields of conspiracy theory concerning Diesel's questionable death in 1913' but we'll leave that for later and other threads.

Gov't tax policy is pegged to oil so therefore all gov't policy and subsidy is driven towards oil itself. For someone growing hemp, pressing the seed for it's oil and then pouring said oil into their car or truck, there is no tax mechanism in place within such practice so from a governance POV, the incentive is to steer clear of such innovative, local and even green friendly practices.

And what if some innovator designed a fuel system that gave a vehicle the capacity to get 200 mpg? Could there be enough local oil sources to provide for such local needs on that level of scale? But we then come back to the issue of tax revs to the various govt's from local to national and the impact of a regional car fleet, this case the midwest, all getting 200 mpg plus?

And we've not even addressed the effects on corp. profits yet so here is our first hurdle, how to let the midwest be self sustaining and self determining? Or in effect, how to let the midwest actually have a real free market?

wkmac

Well-Known Member

Because free marketers in the midwest would want to sell their wares south of the Mason-Dixon line and at a premium. Plus, I wonder if we could even grow enough of any plant to power the city of Chicago let alone the rest of the midwest.

But if free marketeers did go south, it still leaves a local market for micro producers to fill the void. The current market you are locked into limits the entry points so when your ideal of free marketeer goes to the coast, your scenario comes to past. The other part of your scenario is that your free marketeers only got the way they did because of state privilege and state subsidy about on the scale to make even a welfare queen blush. Remove all of that and the creation of false markets and public subsidy of them would disappear and then the most cost effective use of products would be more local in practical terms. You might take a product off shore but without the various subsidy up and down the cost/risk line, the net profits are much smaller so just on profits, the majority of production would stay home.

Think what if the oil companies had to absorb all the risks of extracting oil out of the Middle East and there was no US gov't paying off local govt's through foreign aid and no US Military keeping the peace and transit lanes open? What then? The other question becomes, what would the real cost of a gallon of gas be then? And the next question, how much does a gallon of gas cost in real dollars when you factor in the public subsidized portions?

Answer to the 2nd question: It's true per gallon cost is $6 on the low side to $15 on the high, depends on the source of the figure. The $15 includes the cost of subsidizing as it relates to the environmental costs (you think BP footed the entire bill of the Deepwater spill?). The $6 is towards the basics like shifting certain risk factors onto the public and military/foreign policy related protections. Talk with policy wonks and they consider this a public investment towards tax revs. ends but other studies suggest we taxpayers are coming out on the short side of the stick no matter how you slice and dice it.

Amazingly, today, Rush Limbaugh stated that gas prices have never hit 5 dollars a gallon in the USA..., but in 2007 here in california, gas prices were at 6 dollars a gallon in parts and over 5 dollars in other parts.

Why the mis information? Why back during the Bush administration, RUSH said he would never change to a higher mileaged car, and he would drive his 8 cylinder mercedes benz all day long even if gas rose to 10 dollars a gallon?

Why now does he have problems with the price of oil and why has he abandoned his supply and demand capitalism position?

There is plenty of supply, so much that a good percentage of it is being sold to china and india. There is no shortage, there is TOO MUCH oil in this country. There is also HUGE PROFITS to make on FEAR.

The right wing is drumming up FEAR and its supporters just fall in line. Some on this board may cheer for the collapse of our economy, but it aint going to happen.

Today, unlike BUSH, the economy is sound and growing. When Bush had oil this high, the housing market crashed, the banking industry crashed, the auto industry crashed, the stock market crashed... and this time OBAMA has all of these industries running in the black.

The oil companies will earn windfall profits that will drop the jaws of the american public and that will backfire on the GOP.

Peace.

TOS

Why the mis information? Why back during the Bush administration, RUSH said he would never change to a higher mileaged car, and he would drive his 8 cylinder mercedes benz all day long even if gas rose to 10 dollars a gallon?

Why now does he have problems with the price of oil and why has he abandoned his supply and demand capitalism position?

There is plenty of supply, so much that a good percentage of it is being sold to china and india. There is no shortage, there is TOO MUCH oil in this country. There is also HUGE PROFITS to make on FEAR.

The right wing is drumming up FEAR and its supporters just fall in line. Some on this board may cheer for the collapse of our economy, but it aint going to happen.

Today, unlike BUSH, the economy is sound and growing. When Bush had oil this high, the housing market crashed, the banking industry crashed, the auto industry crashed, the stock market crashed... and this time OBAMA has all of these industries running in the black.

The oil companies will earn windfall profits that will drop the jaws of the american public and that will backfire on the GOP.

Peace.

TOS

UpstateNYUPSer(Ret)

Well-Known Member

Local gas stations finally broke the $4 barrier today.

moreluck

golden ticket member

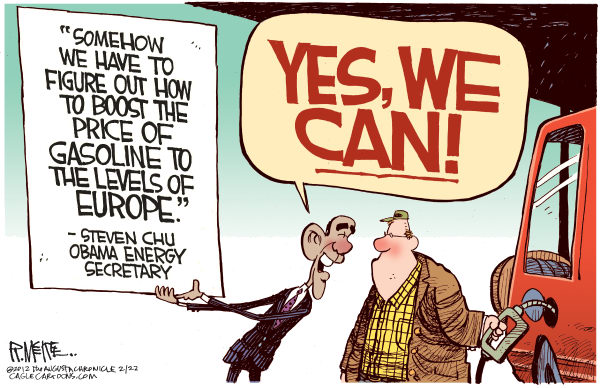

The prez's goal is to free us from dependence on oil. Not foreign oil, but oil !!! He apparently thinks this can happen overnight........but you can't get lower oil overnight. He lives in the unicorn & rainbow land.Amazingly, today, Rush Limbaugh stated that gas prices have never hit 5 dollars a gallon in the USA..., but in 2007 here in california, gas prices were at 6 dollars a gallon in parts and over 5 dollars in other parts.

Why the mis information? Why back during the Bush administration, RUSH said he would never change to a higher mileaged car, and he would drive his 8 cylinder mercedes benz all day long even if gas rose to 10 dollars a gallon?

Why now does he have problems with the price of oil and why has he abandoned his supply and demand capitalism position?

There is plenty of supply, so much that a good percentage of it is being sold to china and india. There is no shortage, there is TOO MUCH oil in this country. There is also HUGE PROFITS to make on FEAR.

The right wing is drumming up FEAR and its supporters just fall in line. Some on this board may cheer for the collapse of our economy, but it aint going to happen.

Today, unlike BUSH, the economy is sound and growing. When Bush had oil this high, the housing market crashed, the banking industry crashed, the auto industry crashed, the stock market crashed... and this time OBAMA has all of these industries running in the black.

The oil companies will earn windfall profits that will drop the jaws of the american public and that will backfire on the GOP.

Peace.

TOS

Oh, and you better check again on that housing industry being in the black......you just make this up?

"Warren Buffett is not the only major investor to admit they were wrong about investing the housing market in the United States. Recently, the California Public Employees' Retirement System, the largest in the country, sold its interest in 28 real estate projects at an estimated loss of $250 million. In a positive report on real estate from Goldman Sachs (NYSE: GS), it was still stated that the housing market in the United States would most likely decline in 2013 and not reach 2006 levels until 2023. It is not just in the United States: n article in The Economist reported that housing still have 50% more to fall around the globe."

http://www.smallcapnetwork.com/Warr...H-SPF/s/via/3420/article/view/p/mid/1/id/671/

"GM still owes taxpayers. The company got $50 billion from our government, and $10 billion more from Canada. They have paid the U.S. back $7 billion plus interest, as I understand it, including the latest payment of nearly $5 billion. So they say they paid us back.

Not quite: That still leaves $43 billion."

http://www.forbes.com/2010/04/21/general-motors-debt-business-autos-gm.html

Last edited:

moreluck

golden ticket member

moreluck

golden ticket member

Monday, February 27, 2012 @ 7:51 pm | [h=2]The Good: Dem Sen. Chuck Schumer Wants To Pump More Oil – The Bad: He Wants Saudi Arabia To Do It…[/h]

Monday, February 27, 2012 @ 7:51 pm | The Good: Dem Sen. Chuck Schumer Wants To Pump More Oil – The Bad: He Wants Saudi Arabia To Do It…

What dont you understand? Saudi Arabia and the OPEC nations have CUT BACK PRODUCTION to around 71% since OBAMA has taken office in order to get prices up on the world market. When BUSH was in office, OPEC and Saudi Arabia said they were producing at 99.9% and couldnt pump anymore into the world markets. Now its operating at a 28% REDUCTION in output and Shumer wants them to raise production, but that will drive the price down per barrel.

We cant continue to be held hostage by the producers and refiners of oil in this country. If this keeps up, I believe the goverment should nationalize the oil industry in the USA.

Peace.

TOS

moreluck

golden ticket member

A comment from TRUMP? Who listens to TRUMP?

The reality is simple. The Saudis have already said that the price of a barrel of oil should be 70 bucks, but its our speculators that are running up the price today, NOT demand. No energy policy will effect change on the speculators who are making millions and billions for oil companies.

Peace.

TOS

klein

Für Meno :)

A comment from TRUMP? Who listens to TRUMP?

The reality is simple. The Saudis have already said that the price of a barrel of oil should be 70 bucks, but its our speculators that are running up the price today, NOT demand. No energy policy will effect change on the speculators who are making millions and billions for oil companies.

Peace.

TOS

I do need to correct you.

The Saudis want $100 a barrel. And they are pretty steady holding it there, too.

Listen to the Saudi Prince himself talking about OIL.... this was from may 2011 but the prince has re-iterated the same sentiments just recently. He talks about SPECULATION ruining the market but he says the price will spike but will come down to between 70 and 80 dollars a barrel where it needs to be. The Prince says that 100 a barrel or higher oil only makes the west seeek alternatives and thats NOT WHAT they want!

Saudi Prince Says Oil Will Be Between 70 And 80 Dollars - YouTube

The US speculators are responsible for the higher prices of oil and something needs to be done about that.

Peace

TOS

Saudi Prince Says Oil Will Be Between 70 And 80 Dollars - YouTube

The US speculators are responsible for the higher prices of oil and something needs to be done about that.

Peace

TOS

Funny how when confronted with the facts on oil, everyone runs from the story. All the political rhetoric will never supercede the voice of the prince of saudi arabia and the price of oil. They know full well that 100 a barrel oil is bad for them and their future.

But what is truly amazing is the facts on oil under OBAMA. Despite the calls for drill baby drill and we need more supply, the facts on oil just dont bear that out.

For the first time since 1949, the United States has EXPORTED more OIL, GAS and DIESEL products than it IMPORTED!

Thats a fact.

U.S. exported more gasoline than imported last year

So why are we paying such high prices for oil? Why are we paying subsidies to oil companies despite ginormous profits? Whos to blame?

How about the right wing and its talking heads and fear mongers who in conjunction with the traders jack up the price of oil just to HURT OUR ECONOMY!

When we can EXPORT more OIL than we IMPORT, then we should be paying pennies for our oil, yet, we are paying high prices for nothing.

Get a clue people.

Peace.

TOS

But what is truly amazing is the facts on oil under OBAMA. Despite the calls for drill baby drill and we need more supply, the facts on oil just dont bear that out.

For the first time since 1949, the United States has EXPORTED more OIL, GAS and DIESEL products than it IMPORTED!

Thats a fact.

U.S. exported more gasoline than imported last year

So why are we paying such high prices for oil? Why are we paying subsidies to oil companies despite ginormous profits? Whos to blame?

How about the right wing and its talking heads and fear mongers who in conjunction with the traders jack up the price of oil just to HURT OUR ECONOMY!

When we can EXPORT more OIL than we IMPORT, then we should be paying pennies for our oil, yet, we are paying high prices for nothing.

Get a clue people.

Peace.

TOS

UpstateNYUPSer(Ret)

Well-Known Member

Facts? You want facts?? Gas Rises for 23 days in a row now.....that's a fact, Jack!

While that may be a fact the reason for the price hike is not quite so clear.

Similar threads

- Replies

- 20

- Views

- 2K