You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Pru 401(K) just started showing up in paycheck?

- Thread starter Brasswolf

- Start date

Brownslave688

You want a toe? I can get you a toe.

Well that's something I sure as hell won't have to worry about.With a retirement account, you don't have to disclose it on any fafsa or some other things that require financial assets, where non retirement accounts do count those things.

Government aid for college will be about zero for my kids I'm sure.

Save now brother. Just paid my last college bill. Can't imagine what it's going to cost in another 20 years.Well that's something I sure as hell won't have to worry about.

Government aid for college will be about zero for my kids I'm sure.

Brownslave688

You want a toe? I can get you a toe.

If it keeps up it won't be worth it.Save now brother. Just paid my last college bill. Can't imagine what it's going to cost in another 20 years.

There's a huge student loan bubble building and something will have to be done in the next 20-30 years.

Unfortunately a college degree might be required by then. Good paying blue collar jobs,will be a thing of the past.If it keeps up it won't be worth it.

There's a huge student loan bubble building and something will have to be done in the next 20-30 years.

Start a 529 asap.

joesmith

Active Member

Just consider yourself lucky i bet there are dozens of old timers around that building who wished they started the 401k earlier.. i know at the moment you were pissed and didn't want anyone messing with you money..but dont be old man in the center with less than 100k in the 401k and cant afford to retire.

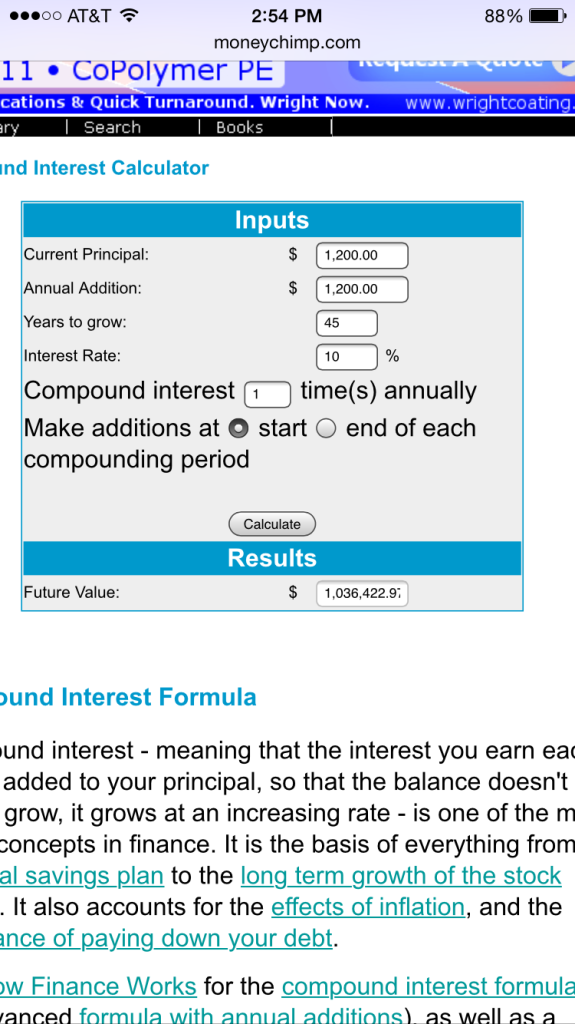

start saving $100 a month every year at the age of 25 in a 401k or ira

and at the age of 65 you could be a millionaire.. i wish i had

start saving $100 a month every year at the age of 25 in a 401k or ira

and at the age of 65 you could be a millionaire.. i wish i had

We had the thrift plan when I started. No 401k.Wish I started earlier as well.

upschuck

Well-Known Member

I didn't get in that either. Thought I needed the money elsewhere, when I was really wasting it. Oh well Live and learn.We had the thrift plan when I started. No 401k.

Can't live in the past. Just look forward . Wish I had some more put away. But I have a lot more than others.I didn't get in that either. Thought I needed the money elsewhere, when I was really wasting it. Oh well Live and learn.

start saving $100 a month every year at the age of 25 in a 401k or ira

and at the age of 65 you could be a millionaire.. i wish i had

Um, no. One hundred dollars a month is $1200 a year. Or $48,000 over the course of 40 years. You'd need a VERY aggressive investment strategy to turn 48k into One million dollars

F

FrigidAdCorrector

Guest

Student loans are going to be the biggest thing stopping me from saving. These universities love to talk about how they are preparing us for the future. But they're preparing many of us for bankruptcy.My son recently started his first "real" job and one of the first things that I advised him to do was to start his 401k. The company (Cobham) offers a full match up to 4% and will match an additional 1% if he bumps that up to 6%. He chose to start at 4% as he has a ton of student loan debt to whittle down but he hopes to be able to go to 6% within the next few years as his salary increases.

You'd be surprised. Unless both you and your wife make an absolute boatload of money it's pretty easy to get financial aid. My mom makes great money, but I can still get about 75% of my tuition covered by loans. Sure it sucks having to pay it all back. But it's better than no help.Government aid for college will be about zero for my kids I'm sure.

Something needs to be done now. I think that bubble burst is a lot closer than many think. Shame on the schools for driving costs up. Corporations aren't the only greedy ones.There's a huge student loan bubble building and something will have to be done in the next 20-30 years.

Brownslave688

You want a toe? I can get you a toe.

Paragraph two has lead to paragraph three.Student loans are going to be the biggest thing stopping me from saving. These universities love to talk about how they are preparing us for the future. But they're preparing many of us for bankruptcy.

You'd be surprised. Unless both you and your wife make an absolute boatload of money it's pretty easy to get financial aid. My mom makes great money, but I can still get about 75% of my tuition covered by loans. Sure it sucks having to pay it all back. But it's better than no help.

Something needs to be done now. I think that bubble burst is a lot closer than many think. Shame on the schools for driving costs up. Corporations aren't the only greedy ones.

I can't really blame the schools. I blame the government loan programs. Tuition was largely kept in check until the government started backing loans.

Brownslave688

You want a toe? I can get you a toe.

oldngray

nowhere special

40 years would give you somewhere about 700k at 10% growth. Aggressive yes. Unheard of no.

10% is possible but unrealistic. You should plan for less with the possibility of being pleasantly surprised with more money. 5-8% is probably more likely.

Brownslave688

You want a toe? I can get you a toe.

I agree and like I said yes 10% is aggressive but more than anything it shows how important years are not just money.10% is possible but unrealistic. You should plan for less with the possibility of being pleasantly surprised with more money. 5-8% is probably more likely.

If you save those $100 a month from 25 on you'll Likely be better off than if you start throwing thousands at it when you're 50+.

brownmonster

Man of Great Wisdom

I enjout watching the government do great things with my money.But why pay the taxes if you don't have to?

Insaneasylum

Well-Known Member

Um, no. One hundred dollars a month is $1200 a year. Or $48,000 over the course of 40 years. You'd need a VERY aggressive investment strategy to turn 48k into One million dollars

Over 40 years 100$ a month @7% interest is just over 250$k. @10% it's 550$k

Browndriver5

Well-Known Member

It's actually not unrealistic for a 10 percent growth over 40 years. I try to do just about everything he advises

http://www.daveramsey.com/blog/the-12-reality/

http://www.daveramsey.com/blog/the-12-reality/

Similar threads

- Replies

- 36

- Views

- 9K

- Replies

- 39

- Views

- 7K

- Replies

- 27

- Views

- 8K

- Replies

- 18

- Views

- 5K