Question: In the laws passed by congress and signed by Bush or any Bush "orders", did any of them include "interest only loans" for people with bad credit or people that could not make the payments?

Was it the president or the banks that presented the loan papers to be signed? How were these interest only deals presented? Was there a clear explanation that the payments would increase by 2/3 on a house that would know owe more on than the original sale price? Did Bush order the lending institutions for hide that pertinent information from buyers?

I also have to wonder what % of the fore closures were do to people loosing their jobs and having basically no income?

Over the years, there has been a very basic "rule" of lending institutions that ones monthly house payment not exceed 1/4 of their monthly income. Did Bush order the banks to ignore that? If he did order that, where and how was the order issued?

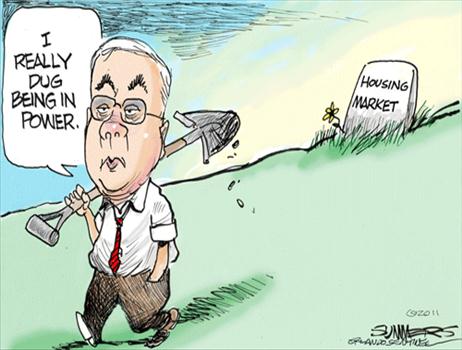

Cool, now youre asking the right questions. I appreciate that. Lets examine some of them (Time constraints) NOT ALL the changes to the regulatory system of housing needed congressional approval. Only the de regulation process allowed the banking and mortgage industry to create the "FINANCIAL INSTRUMENTS" necessary to assist low income, and bad credit buyer. BUSH directly states that BAD CREDIT was a barrier to home ownership and HE was going to REMOVE that "BARRIER"

BUSH called for the creation of NEW FINANCIAL INSTRUMENTS (aka interest only loans) to assist in the first time home buyer process. You are correct, BUSH encouraged both FANNIE AND FREDDIE to set aside 440 billion to "COVER" the millions of homes he was proposing to be built. At a median price of 100K, that 440 billion would have been enough to cover the bet. Unfortunately, the runaway prices changed the original model and both FANNIE and FREDDIE were unable to cover the losses.

How did this happen? Easy, Builders at first used BUSH's idea of 100K homes and they sold at a pace faster than they could be built. Seeing this, the builders started raising prices on the homes in phases. The rate of sales was still outperforming building rates so they raised prices again. What wasnt considered by BUSH or his advisors but caught by Alan Greenspan in 2002 was that the original 440 billion dollars set aside for this massive housing project would soon be in the red as home prices skyrocketed.

friend and friend wasnt able to cover home loans of 1 million or more. It wasnt able to cover homes at 500K either. The original BUSH plan called for 440 billion, but as homes reached outrageous prices, it was obvious that lenders would be stuck holding the bag, so the mortgage selling process started to break down.

Only insiders knew this. When it comes to Barney Frank, when he made the statement about friend and friend, this was at the begining when the 440 billion was in the bank and it was suppose to cover any losses. Frank had no idea what was happening to pricing and trends.

At that time, everyone was making money so nobody wanted to pay attention. Only Alan Greenspan called it like it was and he was not only ignored, but replaced by BUSH.

BUSH clearly went after the low income bad credit market and says so himself.

BUSH:

I set an ambitious goal. It's one that I believe we can achieve. It's a clear goal, that by the end of this decade we'll increase thenumber of minority homeowners by at least 5.5 million families. (Applause.) Some may think that's a stretch. I don't think it is. I think it is realistic. I know we're going to have to work together to achieve it. But when we do our communities will be stronger and so will our economy. Achieving the goal is going to require some good policies out of Washington. And it's going to require a strong commitment from those of you involved in the housing industry.

BUSH:

And so here are some of the ways to address the issue. First, the single greatest barrier to first time homeownership is a high downpayment. It is really hard for many, many, low income families to make the high downpayment. And so that's why I propose and urge Congress to fully fund the American Dream Downpayment Fund. This will use money, taxpayers' money to help a qualified, low income buyer make a downpayment. And that's important.

BUSH:

One of the barriers to homeownership is the inability to make a downpayment. And if one of the goals is to increase homeownership, it makes sense to help people pay that downpayment. We believe that the amount of money in our budget, fully approved by Congress, will help 40,000 families every year realize the dream of owning a home. (Applause.) Part of the success of Park Place is that the city of Atlanta already does this. And we want to make the plan more robust. We want to make it more full all across America.

BUSH:

A third major barrier is the complexity and difficulty of the home buying process. There's a lot of fine print on these forms. And it bothers people, it makes them nervous. And so therefore, what Mel has agreed to do, and Alphonso Jackson has agreed to do is to streamline the process, make the rules simpler, so everybody understands what they are -- makes the closing much less complicated. We certainly don't want there to be a fine print preventing people from owning their home. We can change the print, and we've got to. We've got to be wise about how we deal with the closing documents and all the regulations, but also wise about how we help people understand what it means to own their home and the obligations and the opportunities.

BUSH:

And so these are important initiatives that we can do at the federal government. And the federal government, obviously, has to play an important role, and we will. We will. I mean, when I lay out a goal, I mean it. But we also have got to bring others into the process, most particularly the real estate industry. After all, the real estate industry benefits when people are encouraged to buy homes. It's in their self interest that we encourage people to buy homes

BUSH:

That's why I've challenged the industry leaders all across the country to get after it for this goal, to stay focused, to make sure that we achieve a more secure America, by achieving the goal of 5.5 million new minority home owners. I call it America's home ownership challenge.

BUSH:

And let me talk about some of the progress which we have made to date, as an example for others to follow. First of all, government sponsored corporations that help create our mortgage system -- I introduced two of the leaders here today -- they call those people Fannie May and Freddie Mac, as well as the federal home loan banks, will increase their commitment to minority markets by more than $440 billion. I want to thank Leland and Franklin for that commitment. It's a commitment that conforms to their charters, as well, and also conforms to their hearts.

BUSH:

This means they (Fannie and Freddie) will purchase more loans made by banks after Americans, Hispanics and other minorities, which will encourage homeownership. Freddie Mac will launch 25 initiatives to eliminate homeownership barriers. Under one of these, consumers with poor credit will be able to get a mortgage with an interest rate that automatically goes down after a period of consistent payments.

BUSH:

To help more Americans achieve the American dream of owning their own home, President Bush set a new public-private goal of increasing the supply of affordable housing by seven million over the next 10 years. To meet this goal, the President is calling for passage of his Homeownership Tax Credit and encouraging communities to reduce regulatory barriers through the Department of Housing and Urban Development's America's Affordable Communities Initiative and the President's new Opportunity Zones initiative.

BUSH:

Challenging the Private Sector. The President is calling upon the housing industry, including the, Federal Home Loan Banks, the homebuilders, and the mortgage and finance industry to join with Federal, State, and local governments to help America meet the goal of increasing the supply of affordable housing.

BUSH bragging:

Congress and the President have worked together to accomplish important elements of his strategy - providing downpayment support for low-income families and good financing options for rural buyers. Under President Bush's leadership, overall U.S. homeownership in the second quarter of 2004 reached an all-time high of 69.2 percent. Single-family housing affordability is at its highest level in 30 years, and minority homeownership set a new record-high of 51 percent in the second quarter.