Savvy412

Well-Known Member

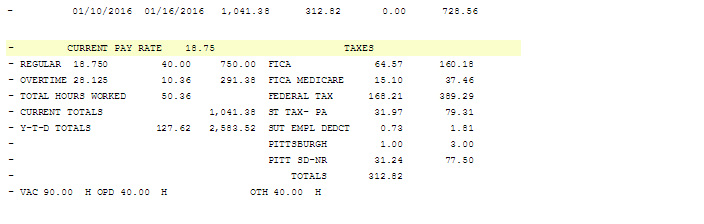

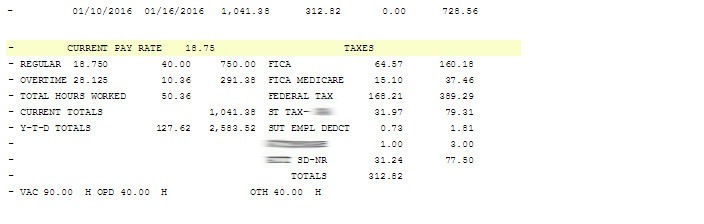

man..every friday I cant even enjoy my paycheck because I look right at my taxes. Im wondering if I filled my W2 out wrong

I got married and had a kid since I last did one so not sure how much of a difference that would make.

*new driver* this paycheck actually should have been $22.75 but you know how that goes.

I got married and had a kid since I last did one so not sure how much of a difference that would make.

*new driver* this paycheck actually should have been $22.75 but you know how that goes.

Last edited by a moderator: