R & D covers that. They've been developing the business and writing off expenses and losses.And?

You said they didn't pay taxes because they had losses for years.

You are wrong.

As usual.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How amazon paid no taxes

- Thread starter Brownslave688

- Start date

DriveInDriѵeOut

Inordinately Right

Nice spin.R & D covers that. They've been developing the business and writing off expenses and losses.

Truth will out.Nice spin.

1989

Well-Known Member

Is it really that difficult to grab and item, put it in a box, tape it up, and put a shipping label on it?i was making $15 an hour doing way easier work than amazon.

i was making $40 an hour doing way easier work than amazon.

im expecting amazon (and the economy) to follow the golden rule which they arent.

Old Man Jingles

Rat out of a cage

Sounds about as hard as a driver’s job.Is it really that difficult to grab and item, put it in a box, tape it up, and put a shipping label on it?

brownmonster

Man of Great Wisdom

Why. WHY?Sounds about as hard as a driver’s job.

1989

Well-Known Member

Obviously you never did the job. More like a preload or unload job.Sounds about as hard as a driver’s job.

1989

Well-Known Member

I have never seen an amazon worker doing “hard work”. Not in the warehouse or at their corporate headquarters.i was making $15 an hour doing way easier work than amazon.

i was making $40 an hour doing way easier work than amazon.

im expecting amazon (and the economy) to follow the golden rule which they arent.

thats because you live a sheltered life. ive never seen it either, but ive read investigative reports on it. its not nice.I have never seen an amazon worker doing “hard work”. Not in the warehouse or at their corporate headquarters.

whats the phrase about big riches and big thefts?

1989

Well-Known Member

WRONG AGAIN. I’ve been in a few amazon warehouses, a couple corporate offices, and a half dozen other offices.thats because you live a sheltered life. ive never seen it either, but ive read investigative reports on it. its not nice.

whats the phrase about big riches and big thefts?

post some articles saying how wonderful the working conditions for amazon warehouse workers are then.WRONG AGAIN. I’ve been in a few amazon warehouses, a couple corporate offices, and a half dozen other offices.

are they unionized?

i worked with one at my job, he was very pissed off at them.

1989

Well-Known Member

I am posting my experiences of hundreds/thousands of times in their warehouses and offices. There will always be people who complain.post some articles saying how wonderful the working conditions for amazon warehouse workers are then.

are they unionized?

i worked with one at my job, he was veryoff at them.

so what are these journalists talking about? what was my coworker talking about?I am posting my experiences of hundreds/thousands of times in their warehouses and offices. There will always be people who complain.

1989

Well-Known Member

There are always exceptions. They are exploiting isolated incidences and poor state laws like most of what you do.so what are these journalists talking about? what was my coworker talking about?

thats comforting to know that we have justice, and whatever injustice we have is an "isolated incidence" as you claim.There are always exceptions. They are exploiting isolated incidences and poor state laws like most of what you do.

post some articles.

1989

Well-Known Member

Again, I am posting my own many hundreds / thousands of experiences in their offices/warehouses over a longer period of time.thats comforting to know that we have justice, and whatever injustice we have is an "isolated incidence" as you claim.

post some articles.

Old Man Jingles

Rat out of a cage

I’ve been there millions of times!Again, I am posting my own many hundreds / thousands of experiences in their offices/warehouses over a longer period of time.

Actually a million times zero.

542thruNthru

Well-Known Member

Is it really that difficult to grab and item, put it in a box, tape it up, and put a shipping label on it?

Sounds about as hard as a driver’s job.

Obviously you never did the job. More like a preload or unload job.

You 1st post answers your 3rd.

I have never seen an amazon worker doing “hard work”. Not in the warehouse or at their corporate headquarters.

And 100s of thousands of people say the same thing about UPS Drivers and they see us all the time also.

Fairness Matters: A Chart Book on Who Pays State and Local Taxes

Overall State & Local Tax Distribution

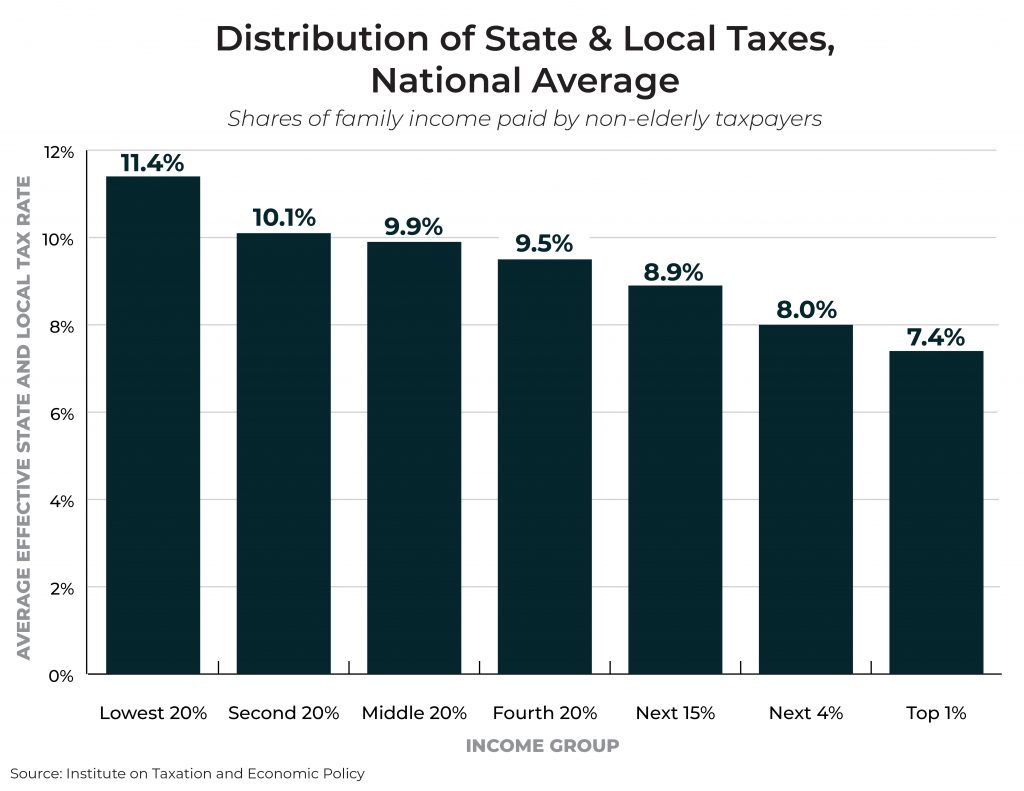

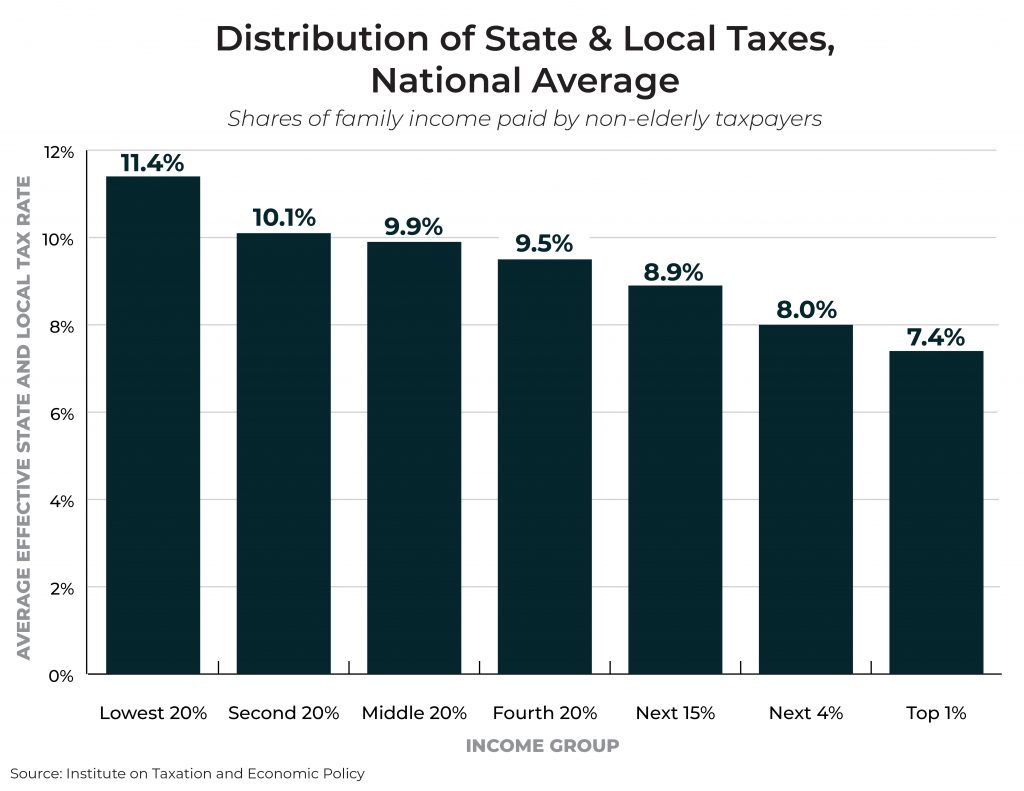

1. State and local tax systems levy the highest effective tax rates on the lowest-income taxpayers.

Virtually every state tax system is fundamentally unfair, taking a much greater share of income from low- and middle-income families than from high-income families. On average, the poorest 20 percent of taxpayers spend 11.4 percent of their income on state and local taxes, which is 50 percent higher than the 7.4 percent average effective rate for the top 1 percent.

While reasons for this disparity vary by state, an overreliance on regressive consumption taxes and the lack of a sufficiently robust personal income tax are two of the most common features of state and local tax codes.

Note: As with the rest of the data underlying this chart book, these figures come from the sixth edition of ITEP’s Who Pays? report, published October 2018.

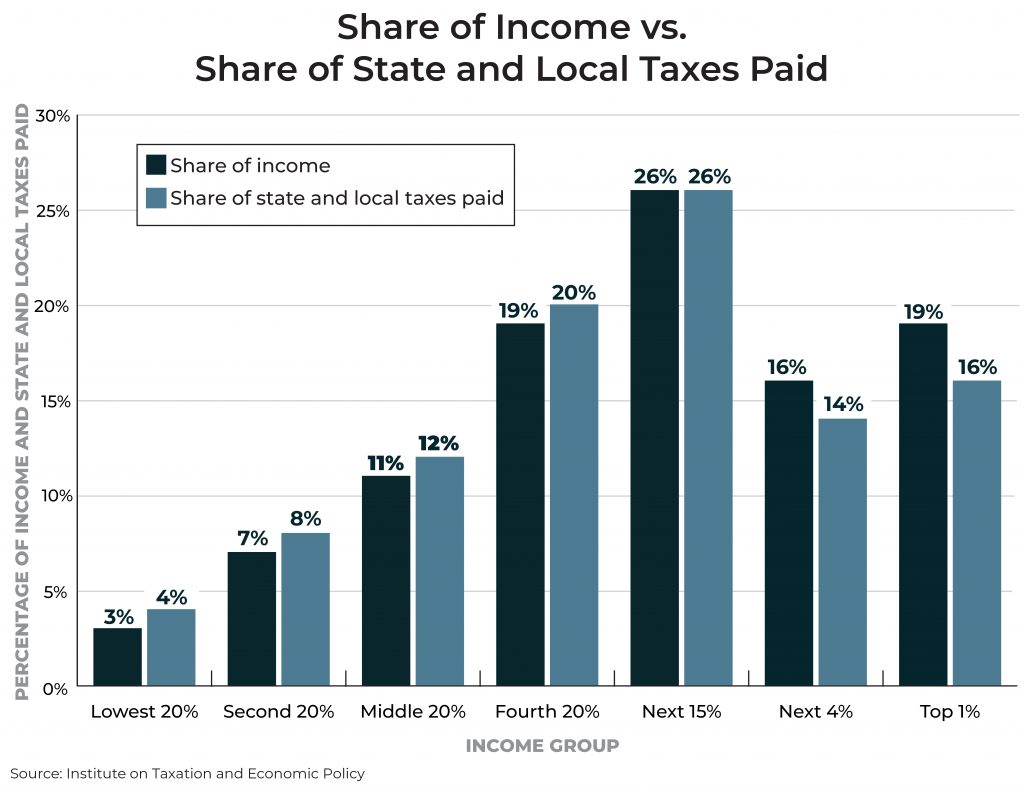

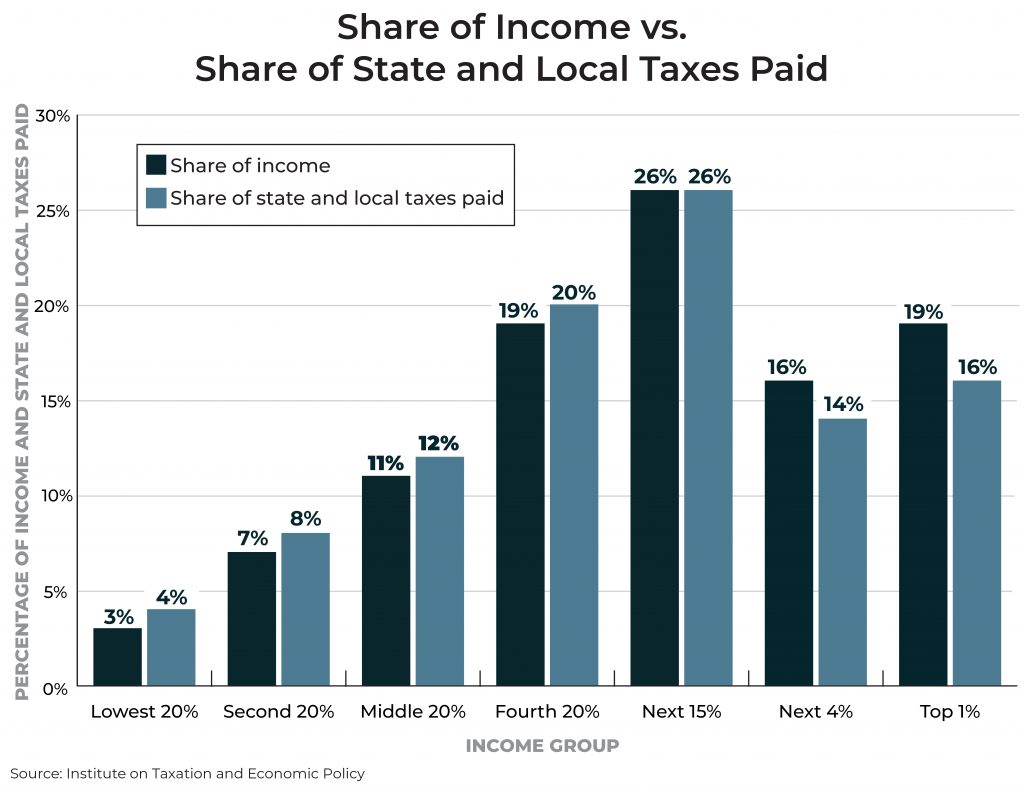

2. Unlike every other income group, the top 5 percent of earners pay a smaller share of state and local taxes than their share of income.

The nation’s income is concentrated at the top. For example, the top 1 percent alone have a combined income that exceeds the bottom half of individuals and families.

Despite this imbalance, state and local tax systems typically ask less of high-income families than of families of more modest means. The top 5 percent of earners pay a smaller share of state and local taxes than their share of income. The bottom 80 percent of families, by contrast, pay a larger share of state and local taxes than the share of income they earn.

Overall State & Local Tax Distribution

1. State and local tax systems levy the highest effective tax rates on the lowest-income taxpayers.

Virtually every state tax system is fundamentally unfair, taking a much greater share of income from low- and middle-income families than from high-income families. On average, the poorest 20 percent of taxpayers spend 11.4 percent of their income on state and local taxes, which is 50 percent higher than the 7.4 percent average effective rate for the top 1 percent.

While reasons for this disparity vary by state, an overreliance on regressive consumption taxes and the lack of a sufficiently robust personal income tax are two of the most common features of state and local tax codes.

Note: As with the rest of the data underlying this chart book, these figures come from the sixth edition of ITEP’s Who Pays? report, published October 2018.

2. Unlike every other income group, the top 5 percent of earners pay a smaller share of state and local taxes than their share of income.

The nation’s income is concentrated at the top. For example, the top 1 percent alone have a combined income that exceeds the bottom half of individuals and families.

Despite this imbalance, state and local tax systems typically ask less of high-income families than of families of more modest means. The top 5 percent of earners pay a smaller share of state and local taxes than their share of income. The bottom 80 percent of families, by contrast, pay a larger share of state and local taxes than the share of income they earn.

Old Man Jingles

Rat out of a cage

I actually did all three including a driver for 18 months.Obviously you never did the job. More like a preload or unload job.

Similar threads

- Replies

- 148

- Views

- 13K

- Replies

- 5

- Views

- 4K