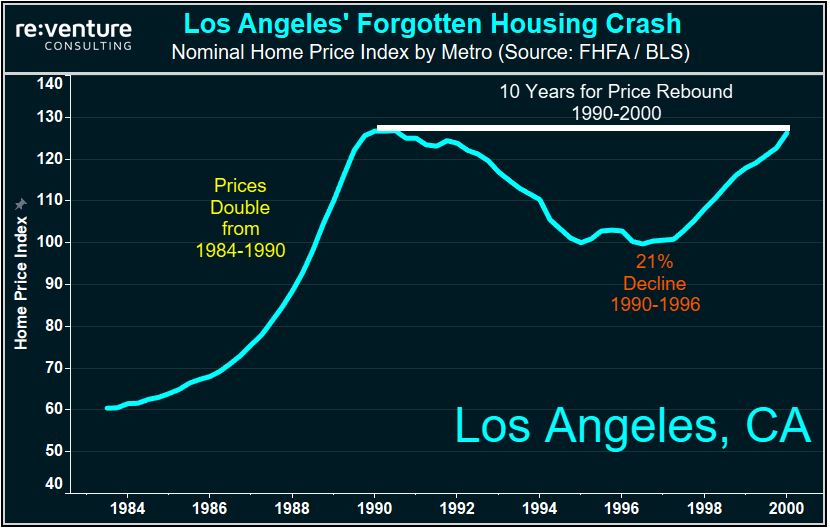

The early 90s in CA had a housing crash…

How bad will the 2021 Housing Crash be? Find out by looking back in history at the WORST Housing Crashes of all-time.

reventureconsulting.com

“It then took another four years for prices to recover to their previous highs. Meaning that those who bought a

home in Los Angeles in 1990 had to wait 10 YEARS – until 2000 – to recover their acquisition value. Note that similar

home price declines also occurred in Orange County and Riverside.”

I sold two condos in Southern California

One in the Alisa Viejo in 2005, for $349,000 was bought in 1995 102k less than 1000 ft.².

Another in Costa Mesa that was purchased new in 1978 for $58,000, sold in 2012 for 380k about 1400 ft.²

Looking at Zillow, both of these condos are close to double those prices now.

No idea how normal people afford Such small living spaces for ridiculous prices.