That's what I did when I bought my house. The amount of interest I saved was more than the price of the houseAnd the numbers are scary if you actually run them. For the average mortgage you’re talking about saving like 175 bucks a month while paying almost double the amount of interest over the life of the loan compared to 30 year.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Are you making enough to make payments on a house????

- Thread starter Over70irregs

- Start date

oldngray

nowhere special

On a 30 year mortgage you probably ending up twice as much in interestThat's what I did when I bought my house. The amount of interest I saved was more than the price of the house

It was a huge difference. But with the price of housing I don't know if the average person can afford to do a 15On a 30 year mortgage you probably ending up twice as much in interest

oldngray

nowhere special

Get a 30 year and pay extra every month if you can. A little bit early on the principal makes a huge difference in the total interest paid.It was a huge difference. But with the price of housing I don't know if the average person can afford to do a 15

That's what my youngest is doing. Or course at 2.5% or so, the interest isn't a big budget killer.Get a 30 year and pay extra every month if you can. A little bit early on the principal makes a huge difference in the total interest paid.

On the other hand it's a similar style as my house but a bit smaller, but it was almost 2.5x the price

Over70irregs

Bans = Control…. Moving on

I pay over every month to principalGet a 30 year and pay extra every month if you can. A little bit early on the principal makes a huge difference in the total interest paid.

Over70irregs

Bans = Control…. Moving on

Maybe this can help someone

www.livemint.com

www.livemint.com

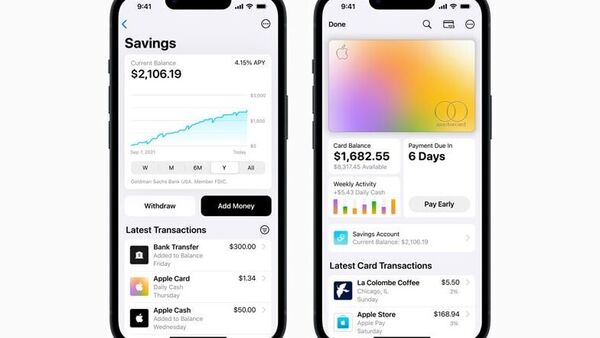

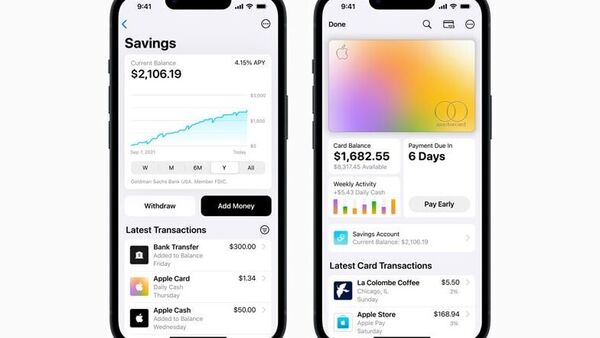

Apple sparks competition with new high-yield savings account offering 4.15% rate

With the new account, Apple's goal is to build tools that help users lead healthier financial lives, and building Savings into Apple Card in Wallet. The iPhone maker is offering interest rate which is more than 10 times the normal average.

Darmark7

Retired 2020. Not my Problem Anymore!

I bought our first house with a 30 yr. Mortgage in 1990. I paid extra every month. When I got a raise it went toward the principle. Paid off that house in 12.5 years. I was 39 yrs old and debt free. After paying off the house I made the payment to myself every month. When I was 46 yrs old I bought a second house with a 15 yr mortgage and paid it off in 2.5 years. Then at 49 yrs old I’m debt free again with 2 houses. I owner financed the first house and get an income for 15 yrs with no headache of being a landlord for renters. This was done on income from me working at UPS. My wife never worked during this time. We just always lived below our means and saved and invested any extra money we had. Retired in 2020 being debt free at 57 yrs old.

Over70irregs

Bans = Control…. Moving on

Keep them coming OG’s. Talk to the jr guys/gals like yall used to.

TeltBender

Well-Known Member

How are drivers who make almost 10k a month not able to afford 30% for a home?Median Monthly House Payment, by State:

1. Hawaii: $4,900

2. California: $4,500

3. Massachusetts: $3,600

4. Washington: $3,500

5. New Jersey: $3,400

6. Colorado: $3,200

7. New Hampshire: $3,100

8. Oregon: $3,000

9. Utah: $3,000

10. New York: $2,900

11. Rhode Island: $2,800

12. Montana: $2,700

13. Idaho: $2,600

14. Connecticut: $2,600

15. Arizona: $2,500

An annual new home payment in California now requires 61% of the median resident's income.

The cheapest state is West Virginia, requiring 19% of annual income for a new home payment.

Buying a house has become a luxury.

Sacrificial Lamb

Package Shepherd

You vill own nothing and you vill be happy.

Over70irregs

Bans = Control…. Moving on

You will own everything but your $ not worth a darnView attachment 425884

You vill own nothing and you vill be happy.

Russia Negotiating Free Trade Deal With India to Facilitate Imports in the Face of Sanctions – Economics Bitcoin News

Russia is negotiating a free trade deal with India to substitute part of the products banned by the sanctions enacted by the U.S. government.

Sacrificial Lamb

Package Shepherd

You will own everything but your $ not worth a darn

Russia Negotiating Free Trade Deal With India to Facilitate Imports in the Face of Sanctions – Economics Bitcoin News

Russia is negotiating a free trade deal with India to substitute part of the products banned by the sanctions enacted by the U.S. government.news.bitcoin.com

Get in ze pod.

Over70irregs

Bans = Control…. Moving on

Humanity is resetting because the $ system is resetting slowly before our eyes. We were just walking now we are in a trot.View attachment 425886

Get in ze pod.

sailfish

Master of Karate and Friendship for Everyone

What would make me happy is Klaus Schwb lighting himself on fire.View attachment 425884

You vill own nothing and you vill be happy.

DELACROIX

In the Spirit of Honore' Daumier

How are drivers who make almost 10k a month not able to afford 30% for a home?

43 dollars an hour X 40 = 1,720 (Gross before taxes etc, etc) a standard 40 hour week, if you are thinking about buying a new house relying on your continual Overtime to cover your mortgage payments....

BrownStains

Well-Known Member

The pay was good 6 years ago but now inflation has gone up drastically so its not as great.

Brownslave688

You want a toe? I can get you a toe.

After 401k and taxes take home is probably 5-6k a month for most people and that’s with a lot of OT.How are drivers who make almost 10k a month not able to afford 30% for a home?

One paycheck a month towards a mortgage that’s a good rule of thumb. No one is brining home even 2k a week after taxes unless they’re working 60 hours every week.

Over70irregs

Bans = Control…. Moving on

How many mortgages are one check?

DriverNerd

Well-Known Member

I average 57+ hours a week, but I also max out my 401k every year and my weekly paychecks are almost always under $1500 except in November and December when I am no longer making 401k contributions.After 401k and taxes take home is probably 5-6k a month for most people and that’s with a lot of OT.

One paycheck a month towards a mortgage that’s a good rule of thumb. No one is brining home even 2k a week after taxes unless they’re working 60 hours every week.