Yes. With a slowing economy. What used to be double digit growth now struggles to see 5%.china is still an emerging economy according to the wto

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Yield Curve is inverted....stocks plummeting...RECESSION is coming

- Thread starter Maple Grove MN Driver

- Start date

Jkloc420

Do you need an air compressor or tire gauge

raising rates and stopping qeBut this bull market has been spurred by the tools used to fight off a bear market. With those already in use, now what?

Jkloc420

Do you need an air compressor or tire gauge

um noYes. With a slowing economy. What used to be double digit growth now struggles to see 5%.

Brownslave688

You want a toe? I can get you a toe.

Dynamite drop in MontyFake news.

KingofFluff

Well-Known Member

Dynamite drop in Monty

Brownslave688

You want a toe? I can get you a toe.

That’s going to help?raising rates and stopping qe

Lol. NoThat’s going to help?

If I had to guess I would say that he thought that China would fold pretty quickly under the weight of the tariffs and he would have had his trade war wrapped up by xmas so he could tout a wonderful new trade deal just in time for the election. Obviously that hasn't happened and now he's in a bit of a bind. Even if he backs down now there's no guarantee that will stave off a downturn.Pretty certain trump knows a recession is coming and due.

He’s trying with all his might to put it off until after election time.

Jkloc420

Do you need an air compressor or tire gauge

no he said the fed was using toolsThat’s going to help?

What a funny gamble! That the Chinese would fold because of economic hardship! What? Is the government afraid they wouldn’t be voted back in?If I had to guess I would say that he thought that China would fold pretty quickly under the weight of the tariffs and he would have had his trade war wrapped up by xmas so he could tout a wonderful new trade deal just in time for the election. Obviously that hasn't happened and now he's in a bit of a bind. Even if he backs down now there's no guarantee that will stave off a downturn.

Sportello

Well-Known Member

he thought that China would fold pretty quickly under the weight of the tariffs

He is an idiot. He is but a speck in the eye to China, a fool to be played.

If I had to guess I would say that he thought that China would fold pretty quickly under the weight of the tariffs and he would have had his trade war wrapped up by xmas so he could tout a wonderful new trade deal just in time for the election. Obviously that hasn't happened and now he's in a bit of a bind. Even if he backs down now there's no guarantee that will stave off a downturn.

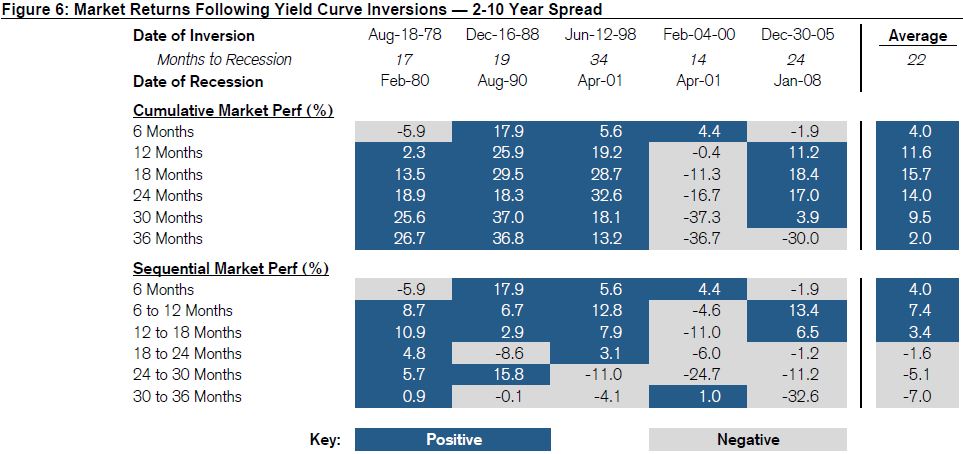

Assuming that a recession is in the works, it has historically taken about 22 months on average to go from an inverted yield curve to a recession.

Source: After a key yield curve inversion, stocks typically have another year and a half before doom strikes

Not like this is an immediate thing...

Brownslave688

You want a toe? I can get you a toe.

I don’t necessarily disagree with the trade war but I don’t think the average American understands how painful it could be.If I had to guess I would say that he thought that China would fold pretty quickly under the weight of the tariffs and he would have had his trade war wrapped up by xmas so he could tout a wonderful new trade deal just in time for the election. Obviously that hasn't happened and now he's in a bit of a bind. Even if he backs down now there's no guarantee that will stave off a downturn.

I told people when he was touting all of this. It sounds great but things will likely get much worse before they get better. And we could be looking a decade into the future before it all plays out.

I would suggest it could be quicker this time because it is global and because the feds arsenal to combat a recession is already nearly exhausted.Assuming that a recession is in the works, it has historically taken about 22 months on average to go from an inverted yield curve to a recession.

Source: After a key yield curve inversion, stocks typically have another year and a half before doom strikes

Not like this is an immediate thing...

Brownslave688

You want a toe? I can get you a toe.

Sometimes I swear English can’t be your first language.no he said the fed was using tools

They don't make 2 year t bills.For a self proclaimed financial guru your understanding is abysmal.

You don't understand what the Yield curve measures l.

The yield curve a comparison of the 10 year and 2 year T Bill yield.

They have been paying more interest on the short term than the 10 year that's an inverted yield curve. Today it went all the way across the board.

Old Man Jingles

Rat out of a cage

How would you know?Wow I thought you were smart.

Apparently not

I would suggest it could be quicker this time because it is global and because the feds arsenal to combat a recession is already nearly exhausted.

I don't have any data on that one, but it sounds reasonable...

Just a bit irritating that all the news outlets make it sound like a recession is going to start tomorrow.

But hey. Drama sells, I guess.

Maple Grove MN Driver

Cocaine Mang!

Did you even read the chart you have posted several times?They don't make 2 year t bills.

They have been paying more interest on the short term than the 10 year that's an inverted yield curve. Today it went all the way across the board.

You have zero clue what you are talking about that much is apparent.

Maple Grove MN Driver

Cocaine Mang!

I am a member of the Cognitive Elite.How would you know?

I am one of the smartest people on this forum.

My intellect dwarfs the combined brain capacity of most of this forum.

Similar threads

- Replies

- 88

- Views

- 5K

- Replies

- 0

- Views

- 1K

- Replies

- 1

- Views

- 1K