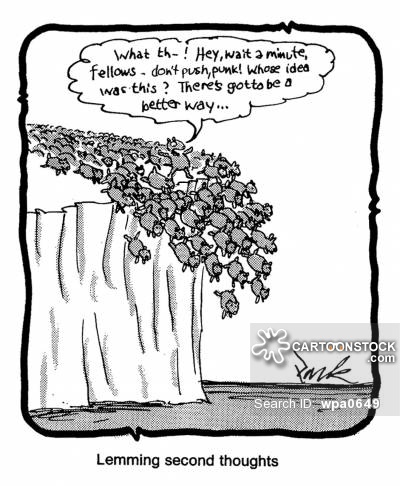

401k assets are protected from creditors and lawsuits.I enjoy reading your sheeple responses. The only reasonably intelligent response was that the government will take a fair percentage of you assets. 401k is the worlds worst place to put money unless its matched. If you have substantial assets when you retire the gov will tax them at ahigher rate than now and you will get reduced SSI and will have to pay high deductibles for your medicare. You will say to yourself "ya well at least I have something" you wont stop for a second to think what inflation (just another tax) is doing to your remaining principle. The rich used to send their assets to banks in Switzerland where banks pay NEGATIVE interest rates. Why? This was enough of a problem that the DOJ went after those accounts and won. For heaven sakes as a fellow driver please enjoy the fruits of your hard earned labor now.

Plus you will never go broke by saving.

Thanks for playing.