You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

moreluck

golden ticket member

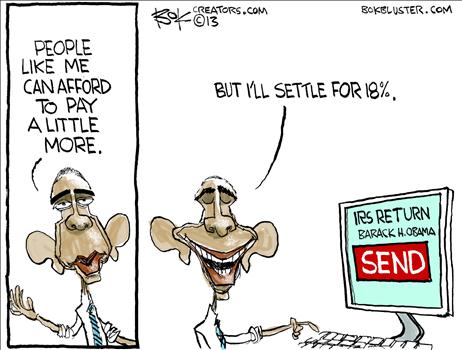

"The richest of Americans should pay their fair share..." Really?? 18.4% Really ???

Make over $600,000.00 and that's not the richest Americans? Why isn't he paying 30 some % ??

Don't bother citing the "soon to be gone" loopholes that he took advantage of........you know, those loopholes that only grumpy old white men use?

Make over $600,000.00 and that's not the richest Americans? Why isn't he paying 30 some % ??

Don't bother citing the "soon to be gone" loopholes that he took advantage of........you know, those loopholes that only grumpy old white men use?

island1fox

Well-Known Member

Obama claims WE should pay our fair share.

The President had the nerve to talk about Romney.

The President had the nerve to talk about Romney.

UpstateNYUPSer(Ret)

Well-Known Member

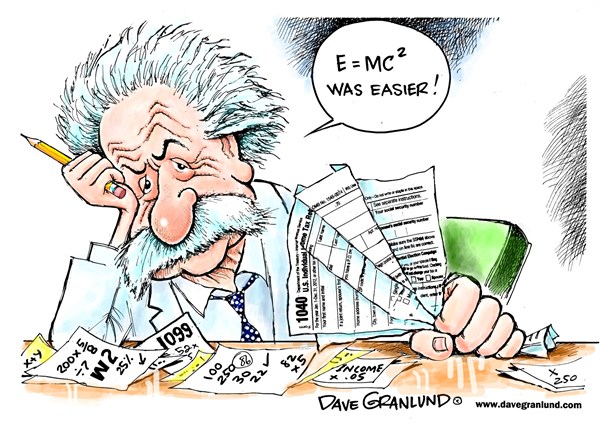

Island, just curious---what was your effective tax rate on your Federal return? Mine was 14.3%.

I finally finished mine last night. I had to write a check for $488 to Uncle Sam and I will get back $231 from my state. My taxes have been steadily going up, I guess due to losing the ability to claim my son as a dependent and my mortgage interest deductions going down. It will probably be much worse next year since I re-financed at 2.75% at the end of last year.

UpstateNYUPSer(Ret)

Well-Known Member

I finally finished mine last night. I had to write a check for $488 to Uncle Sam and I will get back $231 from my state. My taxes have been steadily going up, I guess due to losing the ability to claim my son as a dependent and my mortgage interest deductions going down. It will probably be

much worse next year since I re-financed at 2.75% at the end of last year.

You should be able to write off some of the closing costs, if you had any, from the refi.

May I suggest you adjust your W-4 to have an additional sum ($20?) taken out each week? All else being equal you should have a net zero tax return next year.

UpstateNYUPSer(Ret)

Well-Known Member

I just filed mine. I owe 700 in local, school, and Im getting back 1200. I have them taking it out of my check now, so in some small way that will help, HAHA

Are you talking about your Ohio return? You pay school taxes annually as part of your tax return?

In New York we pay our local school and property taxes in quarterly installments either through our escrow accounts or directly if the house is paid off. If you own your home you do have the option of paying the taxes in one payment rather than quarterly. I don't even see my tax bill and only know that it is paid when Citimortage sends me an e-mail notification. The same goes for my condo insurance.

1/3 of my property taxes are school taxes. Plus we have a school tax. I never knew that when I moved here, so by the time they caught me I was 7 yrs behind. Im caught up now as soon as they take it from my return. I have it taken out of my check now. I t is ridiculous. 750 yr for school taxes that I have never used or stepped one foot in.

UpstateNYUPSer(Ret)

Well-Known Member

$2,400/year combined on a condo assessed at $82K.

island1fox

Well-Known Member

Island, just curious---what was your effective tax rate on your Federal return? Mine was 14.3%.

Ups,

Retired after working four years before UPS and Thirty six years at Ups and the Federal Government still gets 18 % effective rate before the State and city pulls on the rest.

Give Retired people a break --- we have already paid more than our fair share!

wkmac

Well-Known Member

Happy April 15th. Rejoice that Providence has given you good fortune to support The Tiny Dot!

TheTinyDot - YouTube

TheTinyDot - YouTube

wkmac

Well-Known Member

From the piece

as Oliver Wendell Holmes said, that taxes are the price we pay for civilized society.

wkmac

Well-Known Member

wkmac

Well-Known Member

Now if every tax cheating democrat would be so kind and pay up , there would be no reason for any increases in taxes .

But if tax cheats pay those taxes, those monies depart the private economy and it's circulation and then enter the "public" economy to be wealth redistributed by the State. Mostly to crony capitalists or recipients who will backfeed those dollars into the accounts of the crony capitalists. Follow the money!

Looking at the track record of the current State controllers, tell me again who is really benefiting the common folk?

Similar threads

- Replies

- 14

- Views

- 3K

- Replies

- 43

- Views

- 7K

- Replies

- 13

- Views

- 2K