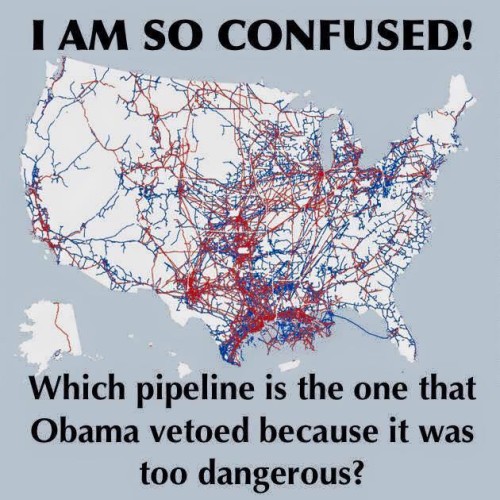

New report also says that U.S. imports of Canadian oil sands will continue to grow regardless of whether or not the pipeline is approved

“There is a common misunderstanding that somehow most or all of the oil shipped to the U.S. Gulf Coast via the Keystone XL pipeline would be exported to other countries,” said Aaron Brady, senior director for IHS Energy. “The reality is that the U.S. Gulf Coast is the world’s largest single refining market for heavy crudes such as oil sands, making it unlikely these barrels would be exported offshore. And, the overwhelming majority of refined products produced in the Gulf are consumed in the United States, regardless of the crude source.”

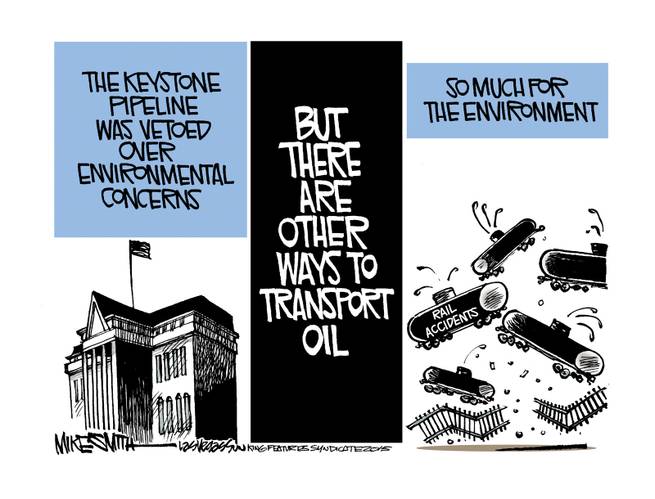

The new IHS report finds that, absent new pipeline capacity, the use of alternate transportation routes—including rail— would still result in the growth of oil sands imports into the United States.

The report also finds that overall growth in oil sands production is expected to continue despite the collapse in oil prices over the past several months. Oil sands projects, the report notes, have a very long time horizon—with production lasting as long as 30 to 40 years—making them relatively resilient to periods of low oil prices.