sailfish

Master of Karate and Friendship for Everyone

WellSon... That's not for you.

.

.WellSon... That's not for you.

.

.Don't beat yourself up. I give you a lot of credit for saving. Go online and so the questionnaire. It may help you choose a better mixWell.

I just did an actual face palm.Stable Value?

If your close to retirement the goal is to keep your money and not take losses.What the heck are you invested in?

He's really youngIf your close to retirement the goal is to keep your money and not take losses.

If your young, that return is horrible.

Imagine if I was putting it in the rightDon't beat yourself up. I give you a lot of credit for saving. Go online and so the questionnaire. It may help you choose a better mix

.

.He is young.If your close to retirement the goal is to keep your money and not take losses.

If your young, that return is horrible.

We all make mistakes. Don't beat yourself up. Now go to your room and do some homework.

We all haveWe all make mistakes. Don't beat yourself up. Now go to your room and do some homework.

He is smart with his money, he has his head on his shoulders.We all have

Not at all. Actually think the conservative agenda would fly through with less drama than with Trump. But then you wouldn't have the speculative bubble and the market would be more rationally valued.Just trolling, gawd you're easy!

Sorry to get you all riled up. And @bbsam , just one more thing.....

#bestpresidentever !

I always love 401k threads. There is always so many experts and bickering! Keeps me entertained during lunch every time.

When it comes to investments, real estate, and sports everybody is an expert. Nobody knows

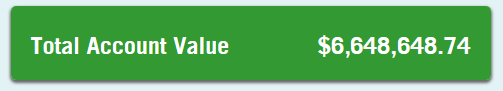

WOWImagine if I was putting it in the right.

Their calculator assumes I'm going to be making this sh*y part-time, mid-progression pay until I retire. It's not taking into account that my income is going to double in a couple years.Don't beat yourself up. I give you a lot of credit for saving. Go online and so the questionnaire. It may help you choose a better mix

I'd be walking out of this hole tomorrow.

Their calculator assumes I'm going to be making this sh*y part-time, mid-progression pay until I retire. It's not taking into account that my income is going to double.

Regardless, you need to be a little more aggressive.Their calculator assumes I'm going to be making this sh*y part-time, mid-progression pay until I retire. It's not taking into account that my income is going to double.