What you're getting at is we need to replace capitalism. Look around you. Capitalism is why the U.S. works. A kinder, gentler form would be nice. But if you want socialism we'll be in an even worse mess eventually.You’re talking about massive deflation. The economy will respond with massive layoffs? The government? Massive stimulus. And the cycle of madness continues.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

These Recession Signals are Flashing...

- Thread starter vantexan

- Start date

We were close to $900 billion this year. Up from $350 billion three years ago.The big difference now is interest rates are high

Even at 4% interest rates the interest payments are probably at least 1.25 trillion per year

A d it's going to go upWe were close to $900 billion this year. Up from $350 billion three years ago.

No. America has always been capitalist. In the 50’s, 60’s, 70’s, 80’s, etc. Somehow people were able to afford a middle class lifestyle. Can they still?What you're getting at is we need to replace capitalism. Look around you. Capitalism is why the U.S. works. A kinder, gentler form would be nice. But if you want socialism we'll be in an even worse mess eventually.

I am suggesting that they really can’t. That’s not good for America nor is it good for capitalism. So what can and should change? Should the social programs like social security, Medicare, Obamacare, VA, get out of the way so that capitalism can thrive? Unions be outlawed to even the playing field? Remove all consumer protections?

If we look at quarterly reports, can we really say that the problem we face is restrained capitalism?

Gotta Go

Well-Known Member

Kiss of death for sure…

Up In Smoke

Well-Known Member

Buffet sold most of those holdings in the first 2 quarters of 2023. The 21B he liquidated went into treasuries and he missed out on the 30% move in the markets in the second half of the year. What's 6B anyway.He was predicting the "Big One" by June '23. Didn't happen. But he has very interesting takes on demographics. A lot more people than he are predicting a major crash and looking at what Warren Buffet has sold recently I think major players are covering themselves.

He is holding cash looking for better deals that are not available right nowBuffet sold most of those holdings in the first 2 quarters of 2023. The 21B he liquidated went into treasuries and he missed out on the 30% move in the markets in the second half of the year. What's 6B anyway.

Up In Smoke

Well-Known Member

Looks like better deal would have been to stay where they were. But who am I to question them.He is holding cash looking for better deals that are not available right now

He does not trade he looks for good dealsLooks like better deal would have been to stay where they were. But who am I to question them.

He feels at the market is overpriced right now and he will take the extra interest in bank it until we can find another one

Babagounj

Strength through joy

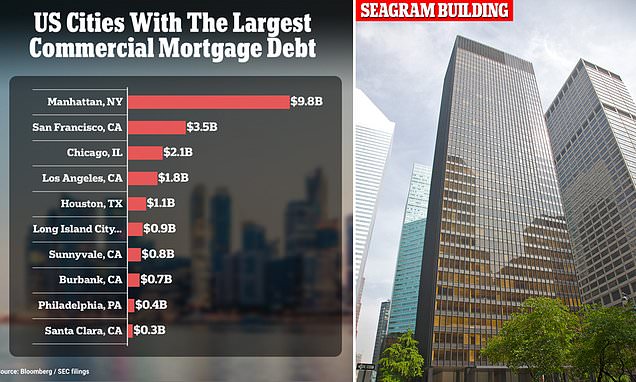

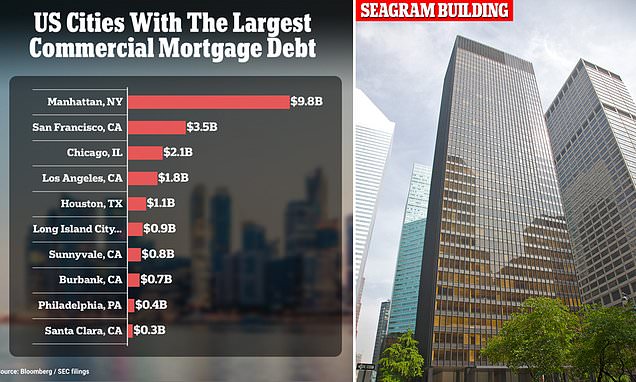

US office buildings face $117BN debt time bomb as mortgages come due

Owners of office space around the country took out their loans when interest rates were half what they are now, and may not be able to refinance them at higher ones.

- Hundreds of loans on office buildings are about to come due at a very bad time

- Loans were taken out in time of low interest rates and are now hard to refinance

- Too many of the loans defaulting could trigger banking crisis and hurt economy

The anvil is going to fall from the sky

US office buildings face $117BN debt time bomb as mortgages come due

Owners of office space around the country took out their loans when interest rates were half what they are now, and may not be able to refinance them at higher ones.www.dailymail.co.uk

- Hundreds of loans on office buildings are about to come due at a very bad time

- Loans were taken out in time of low interest rates and are now hard to refinance

- Too many of the loans defaulting could trigger banking crisis and hurt economy

Look at the PE ratio on stocks

He isn't right all the time. And there's definitely many strategies for investing.He does not trade he looks for good deals

He feels at the market is overpriced right now and he will take the extra interest in bank it until we can find another one

But I do find it amusing how many people trash talk his decisions when they have a net worth less than a hundredth of a percent of his.

PreTrippin’

Stinkin Ginzo

I don’t know what you guys are talking about my Robinhood is on fire. Dogecoin FTW.

Up In Smoke

Well-Known Member

He uses large scale options contracts to facilitate investment strategies and uses the premiums to buy into new positions. They use the Black-Scholes Model and trades them in the European style option rules.He does not trade he looks for good deals

He feels at the market is overpriced right now and he will take the extra interest in bank it until we can find another one

He's not a billionaire by accidentHe isn't right all the time. And there's definitely many strategies for investing.

But I do find it amusing how many people trash talk his decisions when they have a net worth less than a hundredth of a percent of his.

He uses his cash hoard to come in like a vulture when things are badHe uses large scale options contracts to facilitate investment strategies and uses the premiums to buy into new positions. They use the Black-Scholes Model and trades them in the European style option rules.

Better safe than sorry!Buffet sold most of those holdings in the first 2 quarters of 2023. The 21B he liquidated went into treasuries and he missed out on the 30% move in the markets in the second half of the year. What's 6B anyway.

Here's a tried and true idea. Cut taxes. Then cut government spending where you can. Don't take the increased revenue that cutting taxes brings and go on a spending spree. We're closing in on $35 trillion in debt. We have to stop believing we can have equal outcomes for everyone and throw money away trying to achieve that.No. America has always been capitalist. In the 50’s, 60’s, 70’s, 80’s, etc. Somehow people were able to afford a middle class lifestyle. Can they still?

I am suggesting that they really can’t. That’s not good for America nor is it good for capitalism. So what can and should change? Should the social programs like social security, Medicare, Obamacare, VA, get out of the way so that capitalism can thrive? Unions be outlawed to even the playing field? Remove all consumer protections?

If we look at quarterly reports, can we really say that the problem we face is restrained capitalism?

PreTrippin’

Stinkin Ginzo

I want to see 1 quadrillion dollars in debt. It has to end somewhere sheesh.

Similar threads

- Replies

- 49

- Views

- 5K

- Replies

- 77

- Views

- 4K

ED.

ED.