Unless you shorted GameStop....I've already described to you how there is no reasonable possibility of large losses.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Want to leave the company

- Thread starter Mrsb1993

- Start date

wilberforce15

Well-Known Member

Correct. I fully support reddit attacks on hedge funds, but I don't take part.Unless you shorted GameStop....

I don't do shorts. I don't do margin. I don't hold bags.

So what are your top 10 stock picks in this crazy market? in this crazy market?Correct. I fully support reddit attacks on hedge funds, but I don't take part.

I don't do shorts. I don't do margin. I don't hold bags.

wilberforce15

Well-Known Member

I listed them in this thread. They were 2 month recommendations, but I trade in and out of things all the time.So what are your top 10 stock picks in this crazy market? in this crazy market?

Many things on my list were down today, so people attempted to make fun of it. I spent the day mostly in cash, and only traded four things. 80% cash most of the day.

So reraise or whoever else tried to bring it up doesn't understand active management.

Attachments

I just asked, I like to hear other people's perspectiveI listed them in this thread. They were 2 month recommendations, but I trade in and out of things all the time.

Many things on my list were down today, so people attempted to make fun of it. I spent the day mostly in cash, and only traded four things. 80% cash most of the day.

So reraise or whoever else tried to bring it up doesn't understand active management.

wilberforce15

Well-Known Member

I forgot even what I listed.I just asked, I like to hear other people's perspective

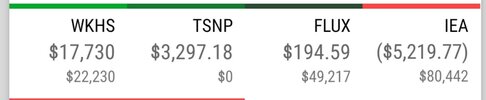

Off the top of my head, good 2 month calls with stop losses would be NDRA, oeg, iea, Flux, ARBKF, mara, EVGN, clsk, sirc, and wkhs

I think we should find all the stocks that are on one to $2 and start buying boat loads of them. LolI forgot even what I listed.

Off the top of my head, good 2 month calls with stop losses would be NDRA, oeg, iea, Flux, ARBKF, mara, EVGN, clsk, sirc, and wkhs

Re-Raise

Well-Known Member

I have played A LOT of poker in my life...including the Main Event a few times.So what are your top 10 stock picks in this crazy market? in this crazy market?

I have met many “poker pros” who thought they had it all figured out and could never go broke. Guess what?

It is gambling! People who think they can get rich quick, most often take bigger gambles than they should. His hubris will be probably be his downfall.

wilberforce15

Well-Known Member

I have played A LOT of poker in my life...including the Main Event a few times.

I have met many “poker pros” who thought they had it all figured out and could never go broke. Guess what?

It is gambling! People who think they can get rich quick, most often take bigger gambles than they should. His hubris will be probably be his downfall.

The poker pros are idiots. Risk management in the market makes it foolproof not to go broke. Rules make it simple and guaranteed, if they are followed.

If you have and respect a stop loss, avoid margin, avoid shorting, and avoid options plays, it's literally not possible to have single large losses.

You got to take a little bit of risk but if you go overboard you're going to get killedI have played A LOT of poker in my life...including the Main Event a few times.

I have met many “poker pros” who thought they had it all figured out and could never go broke. Guess what?

It is gambling! People who think they can get rich quick, most often take bigger gambles than they should. His hubris will be probably be his downfall.

Even though Jim Cramer gets on my nerves I always like his saying

Bulls make money, bears make money and pigs get slaughtered

wilberforce15

Well-Known Member

You got to take a little bit of risk but if you go overboard you're going to get killed

Even though Jim Cramer gets on my nerves I always like his saying

Bulls make money, bears make money and pigs get slaughtered

Going overboard doesn't get you killed if you have a quick, defined, and pre-determined exit plan for any given position.

You cannot combat days like thisGoing overboard doesn't get you killed if you have a quick, defined, and pre-determined exit plan for any given position.

What Was the Stock Market Crash of 1987? What Happened and Causes

The stock market crash of 1987 was a rapid and severe downturn in stock prices that occurred over several days in late October of 1987.

Re-Raise

Well-Known Member

If you are claiming to make 90k in a month..you are gambling plenty! Unless your portfolio is a lot larger than I would guess for a preloader with 6 kids to feed.The poker pros are idiots. Risk management in the market makes it foolproof not to go broke. Rules make it simple and guaranteed, if they are followed.

If you have and respect a stop loss, avoid margin, avoid shorting, and avoid options plays, it's literally not possible to have single large losses.

I would be happy with a 90k gain in a year..and I have over a million invested.

I had a huge gain last year, maybe that's why I'm so nervous right now.If you are claiming to make 90k in a month..you are gambling plenty! Unless your portfolio is a lot larger than I would guess for a preloader with 6 kids to feed.

I would be happy with a 90k gain in a year..and I have over a million invested.

It definitely changed my retirement picture

wilberforce15

Well-Known Member

If you are claiming to make 90k in a month..you are gambling plenty! Unless your portfolio is a lot larger than I would guess for a preloader with 6 kids to feed.

I would be happy with a 90k gain in a year..and I have over a million invested.

You don't understand the nature of active management. My eyes don't leave the price from open until close, and I check probably every 5 or 10 minutes for the entirety of premarket and aftermarket trading. I have algorithms set up for predetermined trades to cover my behind in case of sudden news, and I exit very quickly on any sign of weakness.

My current active trading is using 350k to 500k on any given day with no margin. It's 50 to 100 executed trades on an average day. I often trade the entire account value a few times over within a given day. I am thoroughly protected from a locked-in downside on every single trade without exception, but I capture occasional very large movements.

This is an academic discipline and it is my job. There is a professional way to do this, and I am fully formally educated on the subject.

wilberforce15

Well-Known Member

You cannot combat days like this

What Was the Stock Market Crash of 1987? What Happened and Causes

The stock market crash of 1987 was a rapid and severe downturn in stock prices that occurred over several days in late October of 1987.www.investopedia.com

Yes, I can.

It's easy to feel confident when your portfolio keeps going up but when it starts tumbling downhill it's a hard pill to swallow.Yes, I can.

Best of luck to you young man

wilberforce15

Well-Known Member

It's easy to feel confident when your portfolio keeps going up but when it starts tumbling downhill it's a hard pill to swallow.

Best of luck to you young man

It cannot tumble downhill because I have automatic sell orders placed under every single thing I own, meaning my losses are locked in. I know exactly what my maximum downside is on each position.

And my account is small enough that my orders would get filled. Large institutions can't trade the risk away. It's a much different game for them Small investors and day traders can simply trade the risk away. Small accounts in the millions or hundreds of thousands are much easier to manage for that reason.

Nothing is sure proofIt cannot tumble downhill because I have automatic sell orders placed under every single thing I own, meaning my losses are locked in. I know exactly what my maximum downside is on each position.

And my account is small enough that my orders would get filled. Large institutions can't trade the risk away. It's a much different game for them Small investors and day traders can simply trade the risk away. Small accounts in the millions or hundreds of thousands are much easier to manage for that reason.

What about an internet outage?

Similar threads

- Replies

- 36

- Views

- 13K

- Replies

- 62

- Views

- 8K

- Replies

- 8

- Views

- 2K