How far in progression are you?Ok thanks! Can't wait until I'm top rate though. I'll probably increase my % once I get there.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Time to bump up that 401k

Nothing wrong with that bit when work picks up, crank it back upI've knocked mine down from 20 to 5 when I started driving in preparation of being laid off. I'm not positive it will happen but we have six on vacation today and they didn't work me so I think for now it's probably best to just sit on that extra cash.

Browndriver5

Well-Known Member

I've knocked mine down from 20 to 5 when I started driving in preparation of being laid off. I'm not positive it will happen but we have six on vacation today and they didn't work me so I think for now it's probably best to just sit on that extra cash.

Save up an emergency fund 3-6 months. so you can still invest in situations like these

UnconTROLLed

perfection

13% up from 11%. I finally hit 6 figures this year.

It's a good feeling to have some control over your own destiny13% up from 11%. I finally hit 6 figures this year.

UnconTROLLed

perfection

I am roughly 25-30 years away from collecting a pension, I think you are a bit closer in age due to your locals pension configuration. it's pointless to even think about to me, honestly. The whole thing is so fragile, I'll be lucky to collect anything. IF that day does come and a pension is there, retirement will be a hell of a lot more carefree.It's a good feeling to have some control over your own destiny

Keep savingI am roughly 25-30 years away from collecting a pension, I think you are a bit closer in age due to your locals pension configuration. it's pointless to even think about to me, honestly. The whole thing is so fragile, I'll be lucky to collect anything. IF that day does come and a pension is there, retirement will be a hell of a lot more carefree.

BrownDog5117

Well-Known Member

How far in progression are you?

I went full-time last October. I did some seasonal work before that as a temp so I'm a little over a year I think.

Next progression, pump it upI went full-time last October. I did some seasonal work before that as a temp so I'm a little over a year I think.

BrownDog5117

Well-Known Member

Yeah... I'm at 7% right now. Perhaps next progression raise I'll go to .. maybe 9.Next progression, pump it up

You will not be sorry later on in life...it goes fast, trust meYeah... I'm at 7% right now. Perhaps next progression raise I'll go to .. maybe 9.

I am roughly 25-30 years away from collecting a pension, I think you are a bit closer in age due to your locals pension configuration. it's pointless to even think about to me, honestly. The whole thing is so fragile, I'll be lucky to collect anything. IF that day does come and a pension is there, retirement will be a hell of a lot more carefree.

Same boat for me. I'm doing a Roth/Traditional 401K split in our Prudential setup and a separate Roth IRA with Vanguard that maxes out contributions at $5,500 a year until age 50 (bumps up to $6,500 a year). The main appeal being that withdrawals are penalty and tax free after 5 years of account opening. Can get to the $$ if you need to.

BrownDog5117

Well-Known Member

That's what my parents keep saying... haha!You will not be sorry later on in life...it goes fast, trust me

Listen to them, at least this time.That's what my parents keep saying... haha!

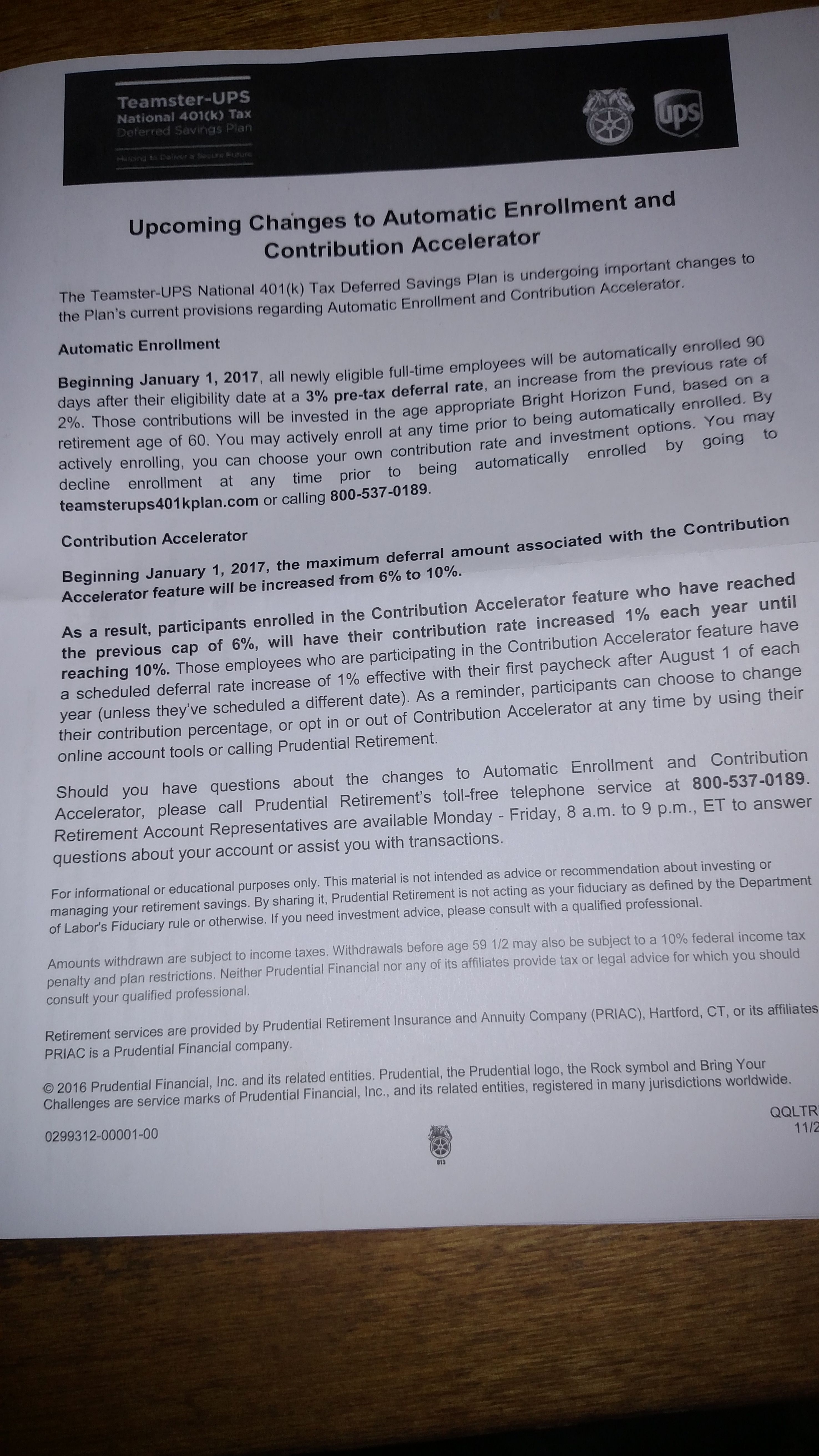

Just got this today

Brownslave688

You want a toe? I can get you a toe.

Interesting....Just got this today

View attachment 107282

Find A fee only planner. They won't try to sell u anything and will look at your 401 and make suggestions move it up to 16% and retire wealthy. I was lucky I started in the early 80's and jumped on the opportunity to let hourly workers buy stock I was young with a growing family but switched my old thrift plan to the stock and ignored the older drivers that said buying stock is siding with the "enemy" these were some of the same guys that said forget the 401 we have a pension. Put as much as u can into the 401 u will be happy later. I'm older now but I think I had almost 3,000 shares at $25 when stock went public it split to 12.50 and went up to $60 when it went public so we had over 300,00 most have gone for tuition but my point is put as much as u can in your 401. Sorry for rambling!!I need to hire someone for my financial stuff. I don't really understand how all this 401k stuff works, I just set it at 10% and let it build up. But should I be changing anything as far as what I invest in?

Rack em

Made the Podium

I agree. I started my 401k as a preloader and have been bumping it up every year. I also have about 40 stocks so far but I only put $20 a week toward that, I just treat it like a savings account.Find A fee only planner. They won't try to sell u anything and will look at your 401 and make suggestions move it up to 16% and retire wealthy. I was lucky I started in the early 80's and jumped on the opportunity to let hourly workers buy stock I was young with a growing family but switched my old thrift plan to the stock and ignored the older drivers that said buying stock is siding with the "enemy" these were some of the same guys that said forget the 401 we have a pension. Put as much as u can into the 401 u will be happy later. I'm older now but I think I had almost 3,000 shares at $25 when stock went public it split to 12.50 and went up to $60 when it went public so we had over 300,00 most have gone for tuition but my point is put as much as u can in your 401. Sorry for rambling!!

I just worry that I am not investing my 401k properly. When I set it up I put most of it towards the S&P500, but I really had/have no idea what I'm actually doing haha.

Similar threads

- Replies

- 36

- Views

- 5K

- Replies

- 20

- Views

- 3K

- Replies

- 6

- Views

- 1K