More than 200 millionaires say they have a message for the corporate executives and billionaires attending the World Economic Forum in Davos this week: "Tax the ultra rich."

The group, which includes actor Mark Ruffalo and Disney heir Abigail Disney, argues that the rich aren't paying their fair share, allowing them to become even richer while inequality widens across the globe.

Meanwhile, a group of lawmakers in seven states plans to introduce bills this week that would raise taxes on the rich, the Washington Post reported. The states include California, Connecticut, Hawaii, Illinois, Maryland, New York and Washington.

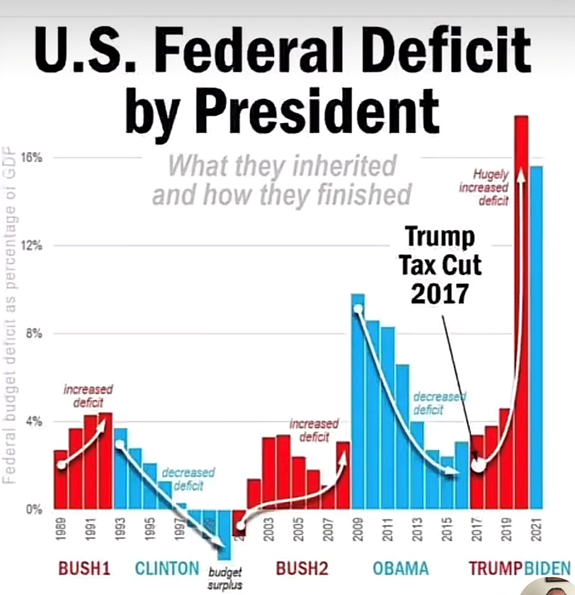

The push for higher taxes on the rich comes as the U.S. is hurtling toward an economic crisis over reaching the debt ceiling, currently at $31.4 trillion, on Thursday. That figure represents borrowing the Treasury taps to fund financial obligations, from social safety-net programs like Social Security to the military budget and infrastructure spending. The number has ballooned from $24 trillion since President Donald Trump's 2017 tax cuts, which primarily helped the rich and corporations lower their tax burdens.

In the past decade, the richest 1% of Americans have seen their wealth grow 19 times faster than the bottom half of the population. On a dollar basis, that means $37 of every $100 has gone to the top 1%, while the bottom 50% received $2, it found.