UnionStrong

Sorry, but I don’t care anymore.

Thanks idiot Joe!No need to panic. Buy the dip.

Thanks idiot Joe!No need to panic. Buy the dip.

Not much of a dip.No need to panic. Buy the dip.

Took Lehman Brothers about a year to implode. Good luck!Not much of a dip.

Evergrande has bond interest payments due September 23rd and 29th. We'll know more at that point.Took Lehman Brothers about a year to implode. Good luck!

I think if the market crashed you’d feel it in other ways than a percentage in your portfolio smhYou come up with these "possible" Great Depression scenarios every couple months. Markets are only off 2 1/2% at the moment. No matter because I moved most of my assets away from volatile areas when I got close to retirement age. I did lose out on a lot of growth but don't have to worry about market crashes.

Evergrade has been imploding for a year. Down almost 90% in a year.Took Lehman Brothers about a year to implode. Good luck!

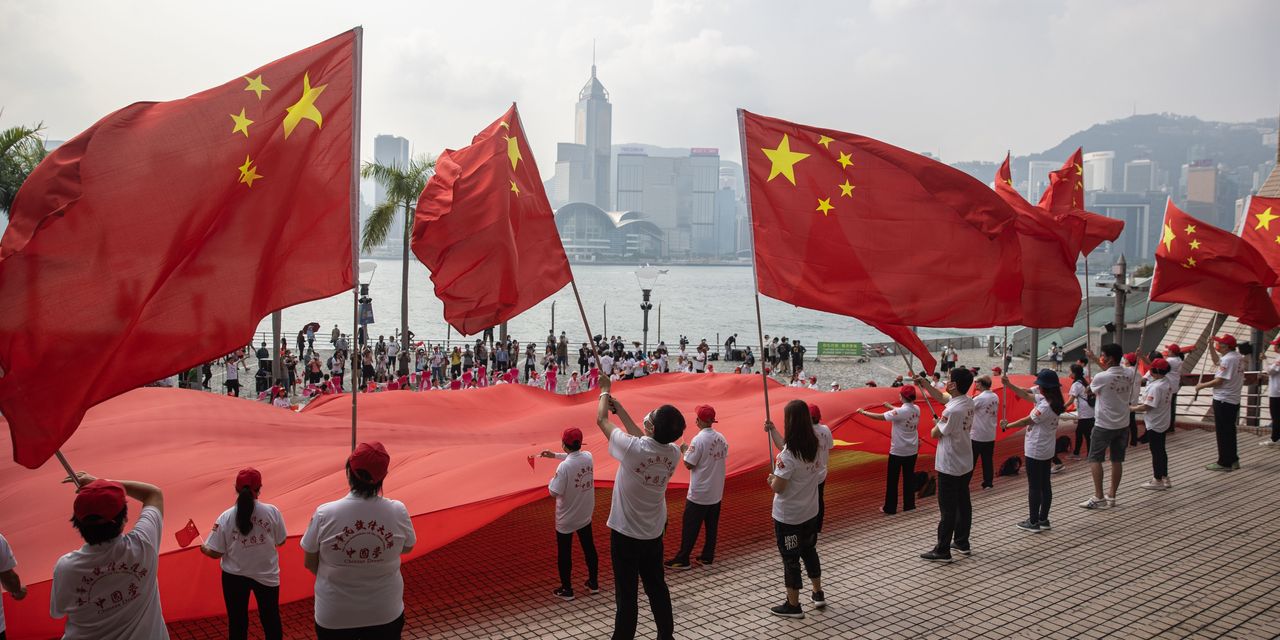

Which is exactly why it has raised a lot of concern lately. But by imploding I didn't mean stock price. Lehman Brothers was over $600 Billion in debt when it finally closed its doors. Burned a lot of investors and nearly caused a domino effect that would've caused an economic collapse if the government hadn't stepped in. Not only is Evergrande poised to do the same but China's government so far has signalled it won't rescue it and that the CCP wants to rein in capitalism and put a more hard line socialist state in place. If the CCP does assist anyone it's likely to be Chinese banks while foreign investors are left holding the bag. Which is why we're seeing foreign stock markets reacting. Could get very interesting when Evergrande's bond payments are due and it doesn't pay them starting Thursday. And a lot of analysts are saying that it's the tip of the iceberg because a lot Chinese companies have played fast and loose with the rules and there's been a lot of foreign investment in China because that was where most of the growth has been in the last two decades.Evergrade has been imploding for a year. Down almost 90% in a year.

the share of real estate and related industries as a percentage of Chinese GDP is 29%. That’s a big problem. Same thing would happen here. Even right now banks are over leveraged even more than 2008. US financial media will do the same thing they did for financial institutions in 2008. They will tell us everything is fine right up until the explosion. This will effect US in some way and that’s a fact.Which is exactly why it has raised a lot of concern lately. But by imploding I didn't mean stock price. Lehman Brothers was over $600 Billion in debt when it finally closed its doors. Burned a lot of investors and nearly caused a domino effect that would've caused an economic collapse if the government hadn't stepped in. Not only is Evergrande poised to do the same but China's government so far has signalled it won't rescue it and that the CCP wants to rein in capitalism and put a more hard line socialist state in place. If the CCP does assist anyone it's likely to be Chinese banks while foreign investors are left holding the bag. Which is why we're seeing foreign stock markets reacting. Could get very interesting when Evergrande's bond payments are due and it doesn't pay them starting Thursday. And a lot of analysts are saying that it's the tip of the iceberg because a lot Chinese companies have played fast and loose with the rules and there's been a lot of foreign investment in China because that was where most of the growth has been in the last two decades.

Bidens going to save us all motherer

That looks like @IVE GOTTA PACKAGE 4U

Dow Jones up over 300 points today. All indexes up 1%. Anymore financial predictions Chicken Little? "The sky is falling, the sky is falling."Big commercial real estate firm in China, Evergrande, has $300 billion in debt and is having serious difficulty servicing it. The Hong Kong stock exchange dropped 794 points today and has dropped thousands of points in the last couple of weeks. Banks from all over the world are heavily invested in Evergrande and this could start a liquidity crisis, a domino effect. Will be interesting to see how our stock exchanges do today. Bonds, stocks, real estate are all overpriced bubbles and this may be the catalyst that pops them. As in an eventual 50-70% drop, maybe more.

So one day is all it takes? Guess you're one of those folks who must have immediate results or thinks it's all a lie. I'm not making up stuff, just relaying what I've seen discussed extensively by very respected major players. If you want to not believe any of it that's your prerogative. It's not just China, there are serious structural issues that eventually will come to a head. Hope you aren't exposed financially when they do.Dow Jones up over 300 points today. All indexes up 1%. Anymore financial predictions Chicken Little? "The sky is falling, the sky is falling."

LOL says the guy who probably first heard of Evergrande 4 days ago hahahahahaEvery time you post something, you make me cringe due to your stupidity and ignorance. If Evergrande goes bust, it can have major consequences for everyone including you. You wouldn't be posting your "LOL" like a teenage girl if you understood just how serious this is.

Dow up over 500 points today.Evergrande has bond interest payments due September 23rd and 29th. We'll know more at that point.

You scoffed at it being down 2% the other day but now want to use it being up to bolster your argument. You have no clue what's coming but want to laugh at anyone pointing out there are serious cracks in the dam that eventually will cause that dam to fail. I suspect you're saying this because there's a Democratic administration in charge and this looks like a negative for them. This has been a long time coming and every administration from George W. Bush onward has contributed. Simply put everything is highly overvalued and the levels of government, corporate, and personal debt aren't sustainable. Anyone who believes that debt can continue to grow forever with no negative consequences is just either uninformed or in denial. And as seen in 2008 the bigger the bubble the bigger the burst. And today's bubbles are way beyond what we had in 2008.Dow up over 500 points today.

OMG thank you for that breaking news!!!!Dow up over 500 points today.

It’s irrational exuberanceOMG thank you for that breaking news!!!!

Lol

oops.

Chinese Developer Modern Land Fails to Repay $250 Million U.S. Dollar Bond

The Hong Kong-listed real-estate company that focuses on green projects, failed to repay the bond that matured Monday, adding to a string of missed payments by Chinese real-estate companies.www.wsj.com