Jiangshi

Heavily Moderated User, Loves Sailfish

I am not jealous or envious. I have a very good life.I don’t know what each of those people are worth, but I do know jealousy and envy, are very unflattering.

I am not jealous or envious. I have a very good life.I don’t know what each of those people are worth, but I do know jealousy and envy, are very unflattering.

Housing costs made up almost 50% of the CPI number and labor costs are driving the PPI numbers. The hot CSI numbers show that spending is still driving a very robust economy. We are seeing a steady housing market in our area, lead by institutional buyers and cash buyers. We need a good recession to bring down housing costs and reset the labor inflation. If interest rates don't work, raise taxes to slow consumer spending like they did in the 80s

New Home Construction Is Down Almost 22% From a Year Ago. Are Buyers Looking at a Continued Lack of Inventory?

Housing starts are down substantially. Read on to see what that means for you as a buyer.www.fool.com

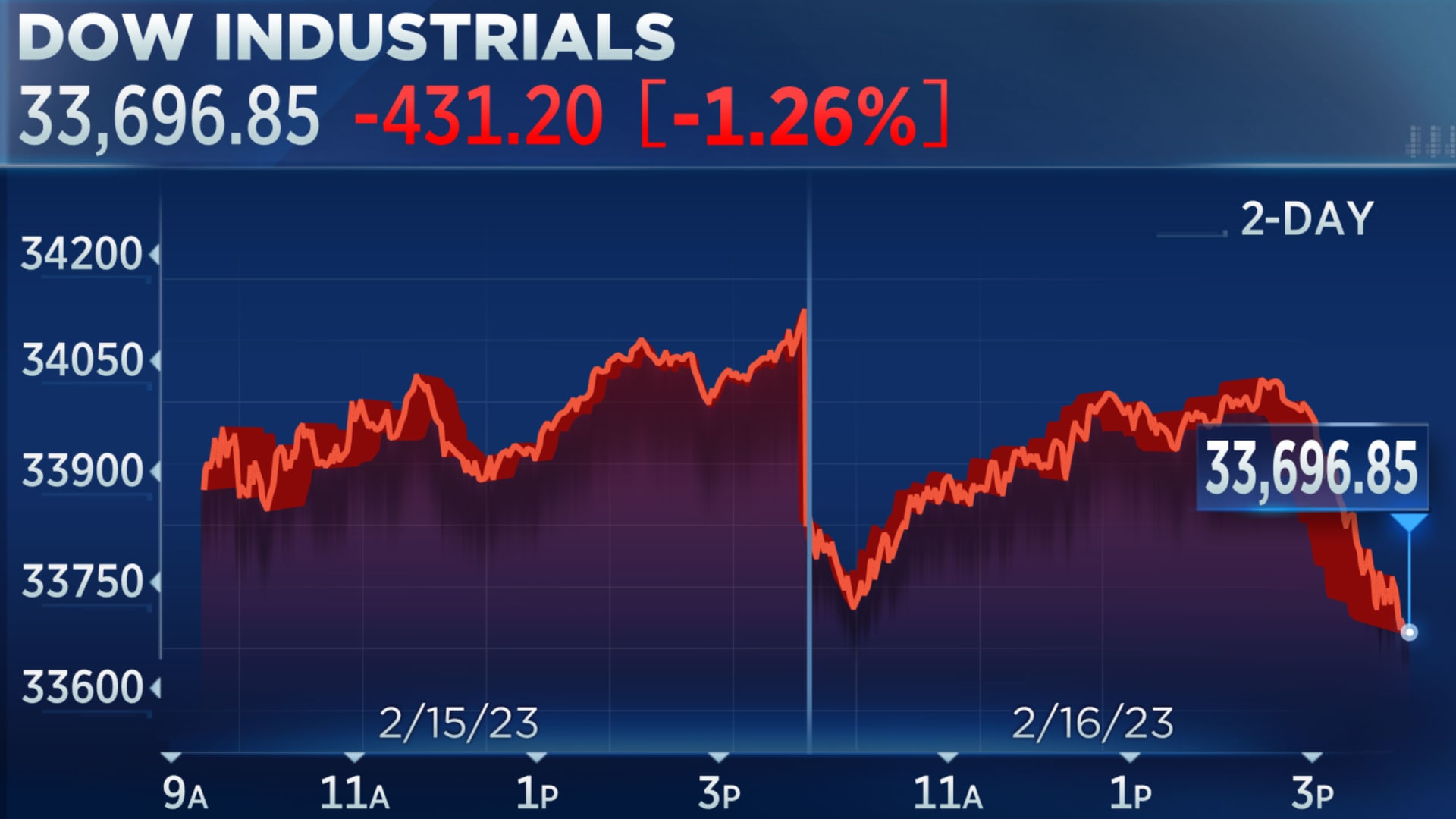

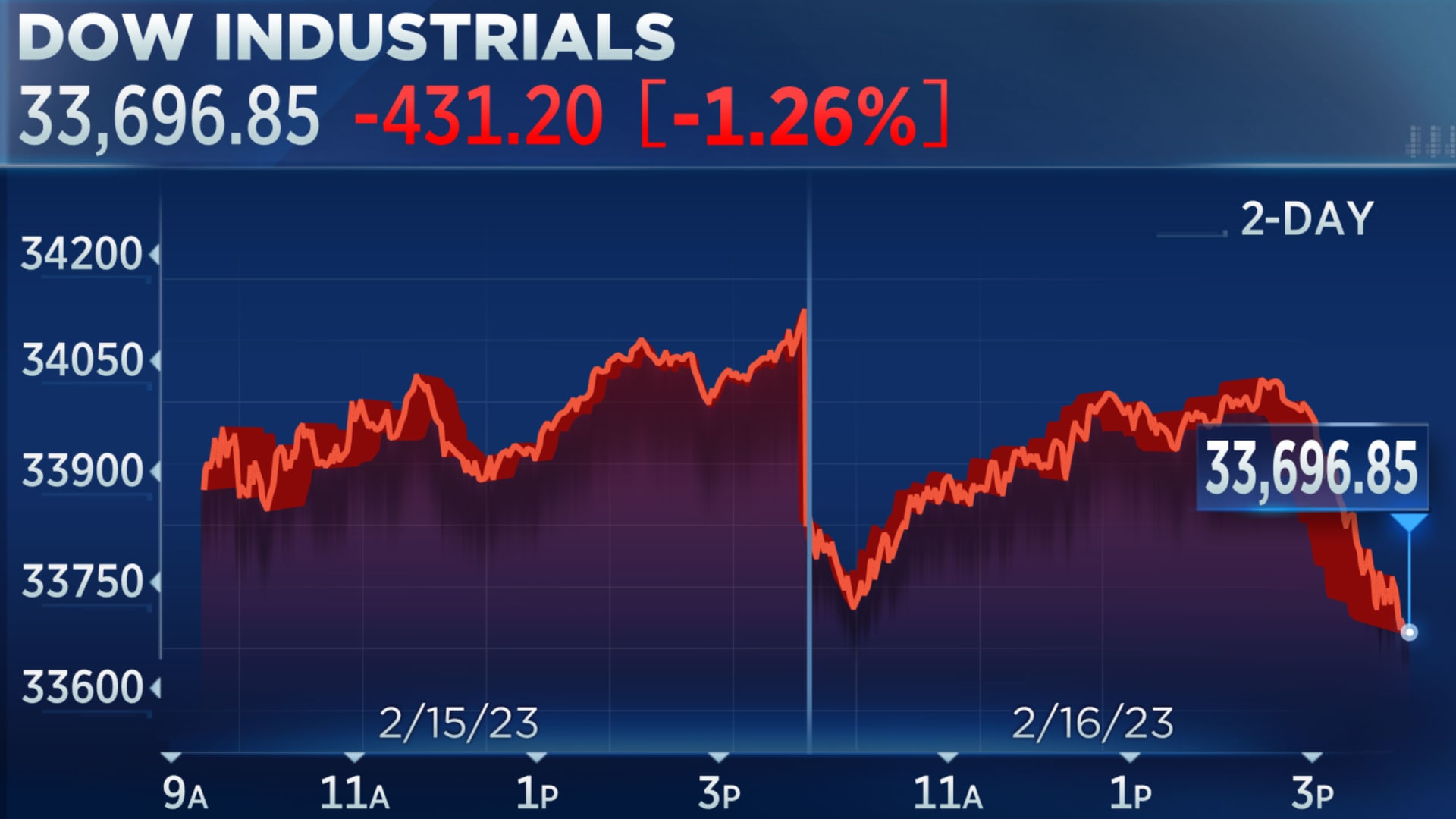

Dow closes 400 points lower as hot inflation report, comments from Fed's Bullard raise rate hike fears: Live updates

"Both inflation readings this week point to the stickiness of inflation and that the fight isn't over," said one strategist.www.cnbc.com

Led, oops.Housing costs made up almost 50% of the CPI number and labor costs are driving the PPI numbers. The hot CSI numbers show that spending is still driving a very robust economy. We are seeing a steady housing market in our area, lead by institutional buyers and cash buyers. We need a good recession to bring down housing costs and reset the labor inflation. If interest rates don't work, raise taxes to slow consumer spending like they did in the 80s

Government already is taking in record revenue.Housing costs made up almost 50% of the CPI number and labor costs are driving the PPI numbers. The hot CSI numbers show that spending is still driving a very robust economy. We are seeing a steady housing market in our area, lead by institutional buyers and cash buyers. We need a good recession to bring down housing costs and reset the labor inflation. If interest rates don't work, raise taxes to slow consumer spending like they did in the 80s

Raise taxes…LolHousing costs made up almost 50% of the CPI number and labor costs are driving the PPI numbers. The hot CSI numbers show that spending is still driving a very robust economy. We are seeing a steady housing market in our area, lead by institutional buyers and cash buyers. We need a good recession to bring down housing costs and reset the labor inflation. If interest rates don't work, raise taxes to slow consumer spending like they did in the 80s

The tax cuts gave everyone more money to spend monthly, which they did. Spending drove up housing, autos, furniture, appliances and hundreds of other goods. Raising taxes as they did in the 80s, would suppress spending and lower inflation. My hope is interest don't need to go into the double digits to curb inflation.Raise taxes…Lol

Yes, but running a trillion dollars short of spending.Government already is taking in record revenue.

Funny how inflation didn’t go up until oil went up. It’s the policies of this imbecilic administration not tax cuts that caused inflation.The tax cuts gave everyone more money to spend monthly, which they did. Spending drove up housing, autos, furniture, appliances and hundreds of other goods. Raising taxes as they did in the 80s, would suppress spending and lower inflation. My hope is interest don't need to go into the double digits to curb inflation.

Cut spending. You don’t raise taxes, that will only hurt. This is why I have a professional financial advisor and not someone on the brown cafe. LolYes, but running a trillion dollars short of spending.

Check again, housing, autos and discretionary goods all rose 12-20% in 2020 as the government pumped trillions of dollars into the consumers pockets. The tax cuts along with the Fed's rate cuts in 2019 started the ball rolling. We saw record profits in 19, 20 and 21 because of low interest rates and little regulation as to who qualifies for loans. Inflation is a worldwide event caused by too much my money in the system. It needs to be removed, but very carefully and slowly.Funny how inflation didn’t go up until oil went up. It’s the policies of this imbecilic administration not tax cuts that caused inflation.

Larry Summers, former economist under the Obama administration and former president of Harvard, warned the Biden administration that injecting trillions in stimulus into the economy would cause inflation. He was right.Check again, housing, autos and discretionary goods all rose 12-20% in 2020 as the government pumped trillions of dollars into the consumers pockets. The tax cuts along with the Fed's rate cuts in 2019 started the ball rolling. We saw record profits in 19, 20 and 21 because of low interest rates and little regulation as to who qualifies for loans. Inflation is a worldwide event caused by too much my money in the system. It needs to be removed, but very carefully and slowly.

Interest rates were too low.Check again, housing, autos and discretionary goods all rose 12-20% in 2020 as the government pumped trillions of dollars into the consumers pockets. The tax cuts along with the Fed's rate cuts in 2019 started the ball rolling. We saw record profits in 19, 20 and 21 because of low interest rates and little regulation as to who qualifies for loans. Inflation is a worldwide event caused by too much my money in the system. It needs to be removed, but very carefully and slowly.

What was Summers opinion on enhanced prolonged unemployment compensation, PPP I, PPP 2, stimulus 1, stimulus 2, stimulus 3, SBA1, SBA2, loan payment cancelation, mortgage foreclosure protection and the dozen other programs passed in 2020?Larry Summers, former economist under the Obama administration and former president of Harvard, warned the Biden administration that injecting trillions in stimulus into the economy would cause inflation. He was right.

His point was enough had been done and to continue would likely cause inflation to hike up. He's not a conservative, and he caused a bit of a stir with the Left with his comments. But he was right.What was Summers opinion on enhanced prolonged unemployment compensation, PPP I, PPP 2, stimulus 1, stimulus 2, stimulus 3, SBA1, SBA2, loan payment cancelation, mortgage foreclosure protection and the dozen other programs passed in 2020?

They sunk most of us.Trump also predicted it as he signed a 900 billion dollar package in late December 2020. The goal is always to sink the other side out of fear of losing the middle.

At least you are finally admitting it was Trump’s policies that caused it.They sunk most of us.

Trump signed a bill put forth by a Democratic Congress, true. Biden and the Congressional Democrats went much farther in 2021 with the spending and if not for Joe Manchin would have broke the bank. Love y'all's revisionist history though.At least you are finally admitting it was Trump’s policies that caused it.