TOS :

I'm surprised you haven't given up yet.

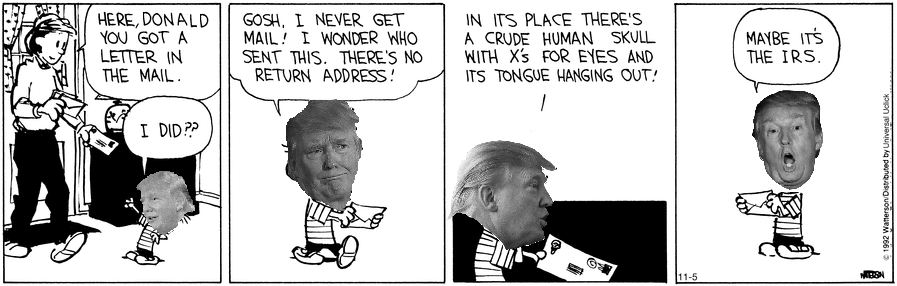

They would vote for Krusty the Clown if he was running as a Republican.

Enjoy his meatless and contimated burgers.

But being a wealthly business guy counts !

I have already won this argument this election cycle.

Notice the overall silence as compared to previous elections. realbrown and Newfie are the new morelucks, and they have been the only "real" diehards on this forum.

Everyone else has been silenced ( as compared to other elections) as they know, this election is over. Even moreluck isnt dumb enough to blast out her usual crap.

She knows its reruns of "that 70's show" again on election night.

For these other newbies weighing in with their support of DRUMPF, well, I dont take them serious, as I dont think they take themselves serious either.

You are correct though, they would vote for Krusty the Clown.

TOS.

Last edited by a moderator: