REITs are getting killed. Better rebalance....some of the funds are pulling down some good gains but i suggest you don't put all your eggs in one basket especially if you are nearing retirement age.

we have our 401k in 7 different funds. the good equity index funds, the international fund ( 20% ) a REIT index fund 5%. a precious metals index fund , some bond funds and about 15% in the SMA. If there is an eventual pull back in equities then precious metals and other funds go up and make it less painful.

The SMA is mostly blue chip stocks that have high yielding dividends.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

401k returns

- Thread starter Joshm

- Start date

olroadbeech

Happy Verified UPSer

that's what we did. the 15 year mortgage was too high to do every month so we took the 30. started applying our tax refund every year to the principle. then 100 a month and then more and more when it was comfortable. paid off house in 17 years and saved $133k in interest. best thing we did as it helped me retire 5 years earlier plus the peace of mind is priceless.Get a 15 year! Or pay a 30 like a 15.

Faceplanted

Well-Known Member

Imagine the stupid drivers now trading and investing in internet funny money aka crypto currency. Whew lad, they are in for a rude awakening.Yup, I was still in delivery and I remember drivers taking the day off so they could stay home and day trade. Most of them lost their ass when it all went down, but at least they still had a job.

LarryBird

Well-Known Member

Yeah, that's great and all. I'm glad you've sort of positioned yourself to weather a down year or two in the market, and maintain a safety net for your wealth.some of the funds are pulling down some good gains but i suggest you don't put all your eggs in one basket especially if you are nearing retirement age.

we have our 401k in 7 different funds. the good equity index funds, the international fund ( 20% ) a REIT index fund 5%. a precious metals index fund , some bond funds and about 15% in the SMA. If there is an eventual pull back in equities then precious metals and other funds go up and make it less painful.

The SMA is mostly blue chip stocks that have high yielding dividends.

But I've gone next level - I have most of my assets in shelf stable foodstuffs, and of course, all of the 5 food groups are covered in my stockpile. Only an idiot wouldn't plan for proper nutrition.

Diversifying is key when it comes to worst case scenario retirement planning - I've got blue chip dehydrated meats and veggies, but I've elected to put my dairy into riskier higher yield assets with more potential for spoilage - I figure my chickens and dairy cow can cover any potential catastrophic loss in this area. It's worth any chances I might be taking, to have a greater supply of milk and cheese - I cannot drink black coffee and cheese makes almost everything better! A well fed child of the apocalypse is a dangerous adversary - so beware me and mine.

I've also branched off into the international market, myself - there's 2 bug out bags ready to roll next to my front door at all times, each with passports, $5k in Euros, $5k in Chinese currency, 8 ozs of gold, a Japanese samurai sword, a german trench knife, a Russian made AK-47, 1000 rounds of Ukrainian ammunition, and a pup tent - made in the USA.

I am ready for whatevs. My planner encouraged us to look deeper, and prepare for the unexpected, and we took what he said to heart, and we ran with it. Sure, it's taken some sacrifices, but it's worth it for the piece of mind.

brownmonster

Man of Great Wisdom

My REIT is up 16%for the year.REITs are getting killed. Better rebalance....

brownmonster

Man of Great Wisdom

No wonder you backed of on the 600k lake home.Yeah, that's great and all. I'm glad you've sort of positioned yourself to weather a down year or two in the market, and maintain a safety net for your wealth.

But I've gone next level - I have most of my assets in shelf stable foodstuffs, and of course, all of the 5 food groups are covered in my stockpile. Only an idiot wouldn't plan for proper nutrition.

Diversifying is key when it comes to worst case scenario retirement planning - I've got blue chip dehydrated meats and veggies, but I've elected to put my dairy into riskier higher yield assets with more potential for spoilage - I figure my chickens and dairy cow can cover any potential catastrophic loss in this area. It's worth any chances I might be taking, to have a greater supply of milk and cheese - I cannot drink black coffee and cheese makes almost everything better! A well fed child of the apocalypse is a dangerous adversary - so beware me and mine.

I've also branched off into the international market, myself - there's 2 bug out bags ready to roll next to my front door at all times, each with passports, $5k in Euros, $5k in Chinese currency, 8 ozs of gold, a Japanese samurai sword, a german trench knife, a Russian made AK-47, 1000 rounds of Ukrainian ammunition, and a pup tent - made in the USA.

I am ready for whatevs. My planner encouraged us to look deeper, and prepare for the unexpected, and we took what he said to heart, and we ran with it. Sure, it's taken some sacrifices, but it's worth it for the piece of mind.

Depends on what kind of holdings they have in the fund. The ones with malls and retail spaces are getting killed.My REIT is up 16%for the year.

brownmonster

Man of Great Wisdom

The one in the Teamster/UPS 401KDepends on what kind of holdings they have in the fund. The ones with malls and retail spaces are getting killed.

Gabba

It's a vicious cycle

my current allocation is set to buy 60% sp500 / 20% midcap400 / 20% russel2000. but i have in the past bought the international fund and the reit fund some.

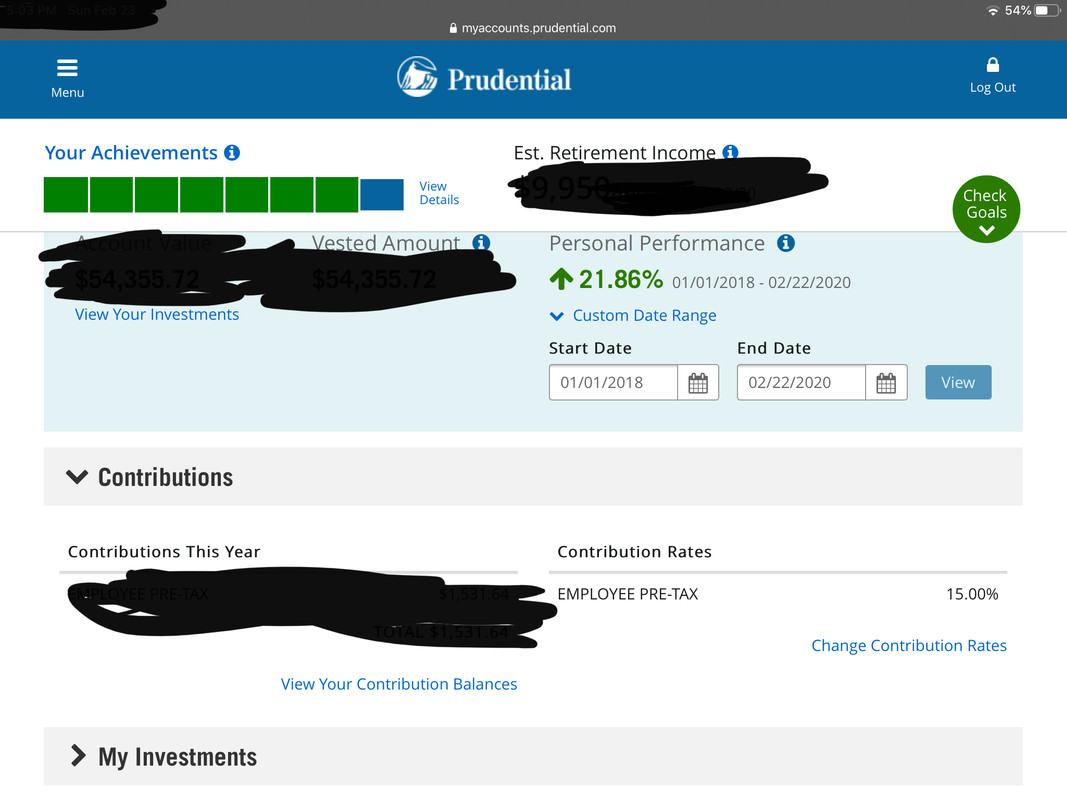

i'm currently up 23% over what i've contributed in the time of about 4 years. the return calculator says i'm up 1.75% ytd, 15% from 1 year ago, 21.89% from 2 years ago.

it's about 50/50 trad/roth, but my contributions are full roth now.

i'm currently up 23% over what i've contributed in the time of about 4 years. the return calculator says i'm up 1.75% ytd, 15% from 1 year ago, 21.89% from 2 years ago.

it's about 50/50 trad/roth, but my contributions are full roth now.

olroadbeech

Happy Verified UPSer

what is your age? you're all in on equities and have no bonds.my current allocation is set to buy 60% sp500 / 20% midcap400 / 20% russel2000. but i have in the past bought the international fund and the reit fund some.

i'm currently up 23% over what i've contributed in the time of about 4 years. the return calculator says i'm up 1.75% ytd, 15% from 1 year ago, 21.89% from 2 years ago.

it's about 50/50 trad/roth, but my contributions are full roth now.

we have about 60% stocks, 10% precious metals , and 30 % bonds. but we are in our 60's so need to cut down some risk. this is just in the 401k which accounts for about only 30% of our total portfolio.

also have some IRA's , real estate , and cash. for the rest.

Jkloc420

Do you need an air compressor or tire gauge

correct picklesThat % includes what you have put in or taken out also. Not just how the market performance has been.

View attachment 284110

correct pickles

I feel like a lot of people think it’s just how the market is doing. At the end of the year if you’ve put $19k in there there’s a reason it says it’s up 15-20%.

ManInBrown

Well-Known Member

Mine is up 31% since 1-20-2017. 100% in the S&P. Switched into that the week before Trump was inaugaratedAnyone getting over 15 percent on their 401/Roth? If so how

My 401k went up almost as much as I made this year workingMine is up 31% since 1-20-2017. 100% in the S&P. Switched into that the week before Trump was inaugarated

ManInBrown

Well-Known Member

olroadbeech

Happy Verified UPSer

I don't think so. They give you the RETURN % and do not take into account your contribution.I feel like a lot of people think it’s just how the market is doing. At the end of the year if you’ve put $19k in there there’s a reason it says it’s up 15-20%.

anyway , that is what they do for mine. I have had negative % returns in years past when we were making max contributions. starting amount would be X, ending amount would be Y ( which was higher than X after contributions )

But return could still be negative because of a neg.market year.

I don't think so. They give you the RETURN % and do not take into account your contribution.

anyway , that is what they do for mine. I have had negative % returns in years past when we were making max contributions. starting amount would be X, ending amount would be Y ( which was higher than X after contributions )

But return could still be negative because of a neg.market year.

Look at the picture I posted above that came directly from the website.

@Pickles knows everything

Similar threads

- Replies

- 6

- Views

- 2K